The R&D tax relief claim notification process is a key component of recent reforms aimed at reducing errors and fraud. The UK government introduced this requirement, believing that genuine R&D is typically planned, ensuring only legitimate claims are made. At Ayming UK, we understand the complexities of R&D tax relief requirements. Our expert team has crafted this guide to simplify the process and help you obtain tax relief for your R&D projects.

What is R&D Claim Notification?

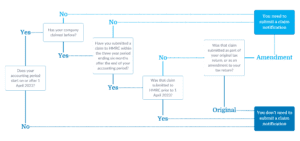

R&D claim notification is the formal process by which businesses inform HMRC of their intention to claim R&D tax relief. It’s mandatory for first-time claimants and those who haven’t claimed in the past three years. To comply, eligible businesses must submit a claim notification form. This requirement is part of broader measures designed to tackle fraud within the R&D tax relief scheme.

While the term “pre-notification” is sometimes used, HMRC prefers the term “notification” to avoid the misconception that this step must be completed before the R&D work starts. In reality, it occurs prior to submitting the claim, not before the R&D itself.

Do I need to notify HMRC?

For R&D tax claims relating to accounting periods starting on or after 1 April 2023, you must notify HMRC if:

- You’re claiming for the first time.

- Your previous claim was more than three years before the current claim notification period ends.

- Your last claim, submitted within the last three years, doesn’t meet specific criteria (outlined below).

How to determine if the three-year exemption applies

If this is your first R&D tax claim, and your accounting period begins on or after 1 April 2023, you must submit a claim notification form.

If you’ve made a prior claim, check whether it was submitted within the three-year window. To do this, calculate the last day of the claim notification period (six months from the end of your accounting period), and count back three years. If your last claim falls within this timeframe, you may not need to notify again. Be mindful of transitional rules, depending on how your previous claim was submitted. If you’re in doubt or need clarification on whether or not the notification rules apply, please get in touch and ensure you don’t miss out.

When to notify HMRC

If your accounting period begins on or after 1 April 2023, and you need to notify HMRC, this must be done within six months of the end of the accounting period for which you are claiming. For example, if your year-end is 31 March 2024, the notification must be submitted by 30 September 2024.

Who can submit the claim notification?

A company representative or an authorised agent may submit the R&D claim notification form.

What information is required for the notification?

To complete the form, you’ll need:

- Your company’s Unique Taxpayer Reference (UTR).

- The senior internal R&D contact in your organisation.

- Details of any agents involved in preparing or advising on the claim.

- Start and end dates of the relevant accounting period, matching your Company Tax Return.

- A high-level summary of planned R&D projects.

How to submit the claim notification form

The claim notification form can be submitted online via the Government Gateway, using a user ID or email address. Once submitted, HMRC will send a confirmation email with a reference number. If you proceed with the claim, you must mark box 656 on your Company Tax Return to indicate that you’ve submitted the notification. No further action is needed if you decide not to continue.

Alongside the claim notification form, you must also submit an Additional Information Form when making the claim.

What happens if I miss the notification deadline?

If you fail to submit a required claim notification form, you will not be eligible for R&D tax relief for that period. Unless your company qualifies for the three-year exemption, HMRC will remove the claim from your Company Tax Return, and you’ll be denied relief, even if your R&D activities meet the eligibility criteria.

What if other parts of our group have previously made claims?

The notification has to be made for each separate company that makes a claim. This means that claims made elsewhere in the group do NOT count as previous claims – these have to made by the specific company making this claim.

This is likely to be of particular relevance for groups that have undergone restructuring, or which have individual companies that only carry out R&D infrequently; some companies may need to do a notification even if other companies have been claiming consistently.

Need help navigating the claim notification process?

At Ayming UK, our certified Chartered Tax Advisors and R&D tax specialists are here to guide your R&D strategy. Whether it’s navigating claim notifications or identifying further innovation funding opportunities, we’re committed to helping your business innovate and thrive. Contact our experts today to see how we can support your innovation journey.