Table of Contents

Introduction

The UK’s innovation landscape has been steadily maturing since the launch of the R&D scheme more than two decades ago. But after a challenging few years, innovation teams face new obstacles as economic turbulence undermines already-squeezed budgets. And adding to the pressure, the announcements made in the Chancellor’s Autumn Statement risk seriously derailing the R&D scheme’s steady momentum.

To maintain and grow the UK’s innovation landscape, greater support is needed across the board – not cuts to existing funding. The Government’s ambition for the UK to become a science superpower is achievable in the abstract but in order for it to become a realistic goal, reforms to the current system are urgently required.

In this report, the inaugural UK Innovation Barometer, we examine the current state of the UK’s innovation landscape, as well as considering the various reforms that have the potential to influence businesses operating across the technology, manufacturing, food & beverage, construction, financial services, and pharmaceutical industries.

All businesses across these sectors are currently seeking ways to become greener, for which innovation is critical. But with such little emphasis placed on the role of green R&D, it begs the question as to how sustainability will become embedded into the innovation process?

In order to stimulate greater innovation across the UK’s landscape and compete at the highest level globally, the Government must adopta coordinated approach that addresses innovation, productivity and sustainability together.

Summary

Among its many findings, this report shows:

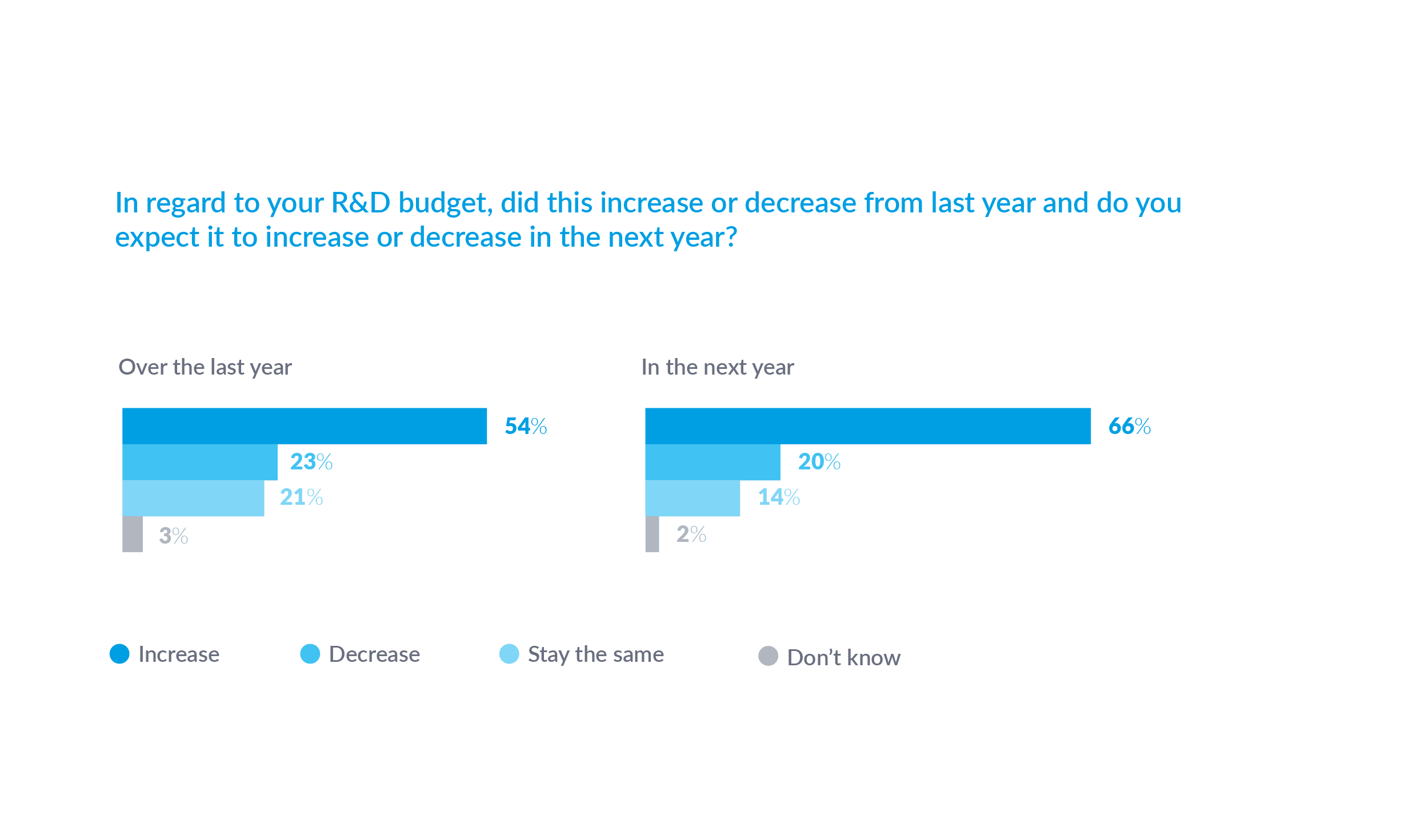

- Budgets are up, and due to increase further: Despite challenging economic conditions, 54% of respondents report an increase in R&D budgets in the last year while 66% of firms plan to increase budgets next year.

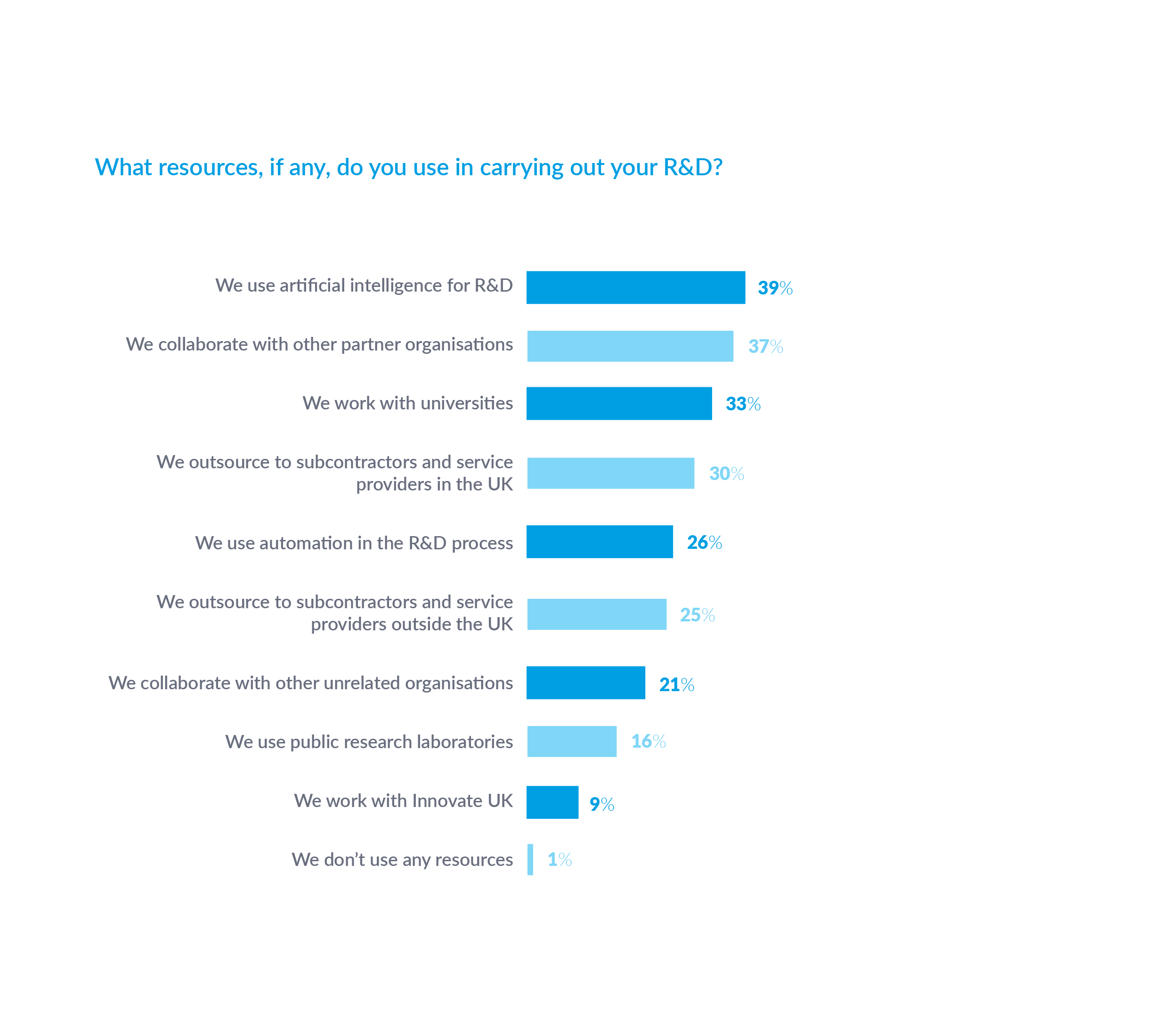

- Artificial intelligence now most popular R&D resource: When it comes to the resources and partners used to carry out R&D, the most popular option is artificial intelligence, selected by 39% of respondents, followed by collaborating with partner organisations, at 37%, and working with universities, at 33%.

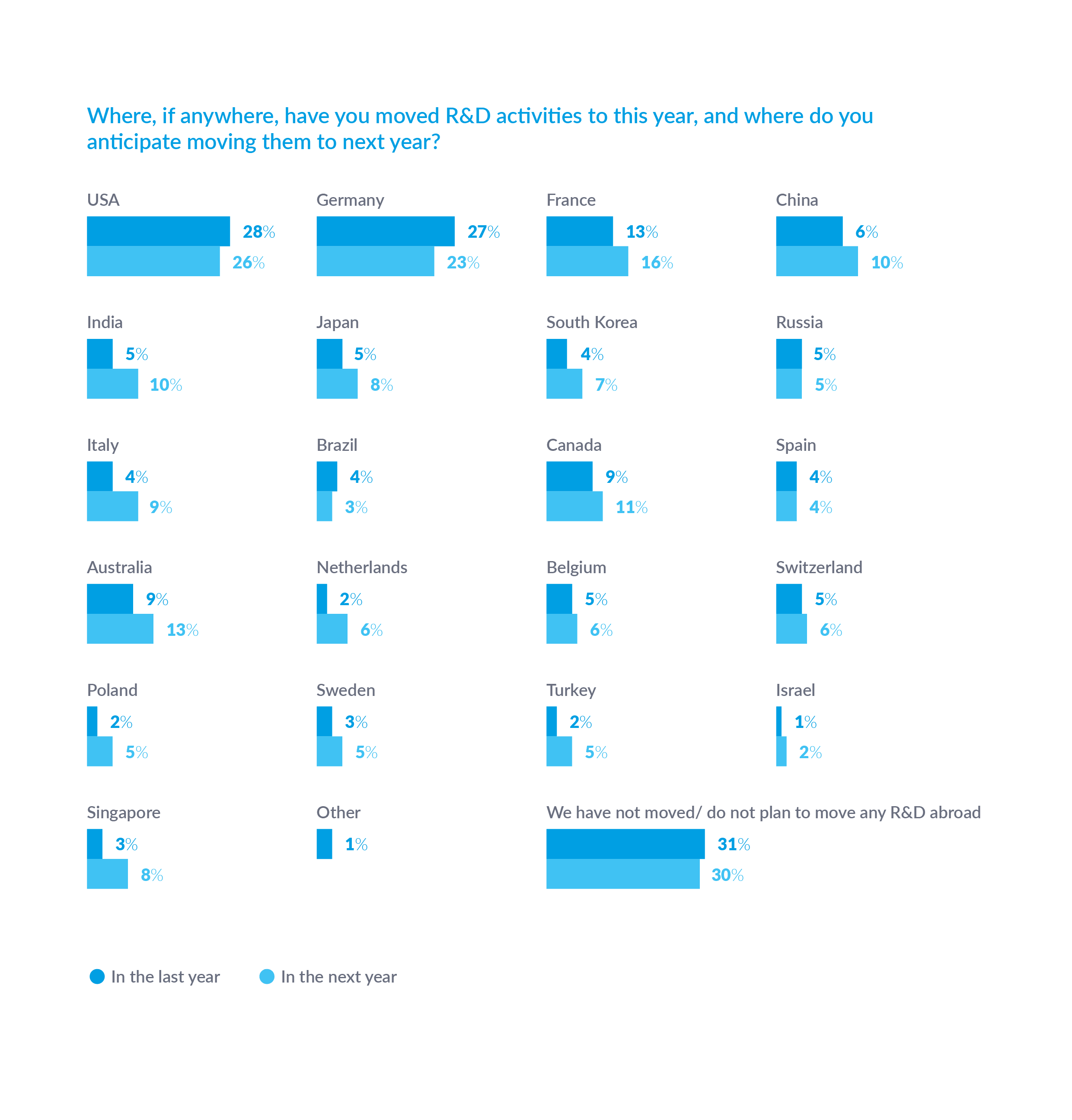

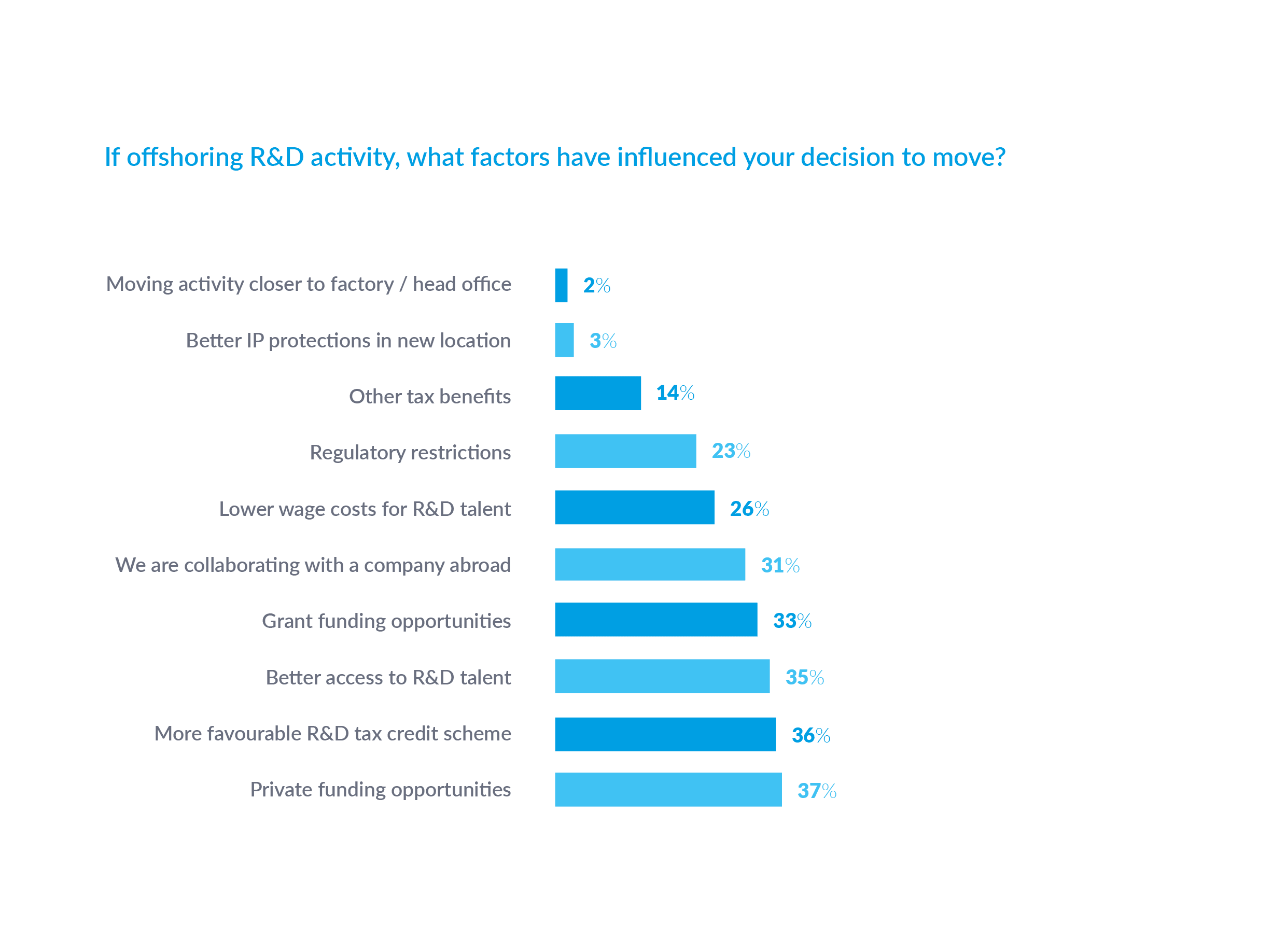

- Exodus of R&D activity from UK: 69% of businesses have moved R&D activity abroad in the last year and 70% plan to move activity abroad next year. The US and Germany are the most popular destinations for moving R&D, selected by 28% and 27% of businesses respectively.

- UK must create more competitive R&D environment: The most popular reason why firms are moving activity abroad is private funding

- opportunities at 37%, followed closely by more favourable R&D tax credit schemes at 36%, and better access to talent at 35%.

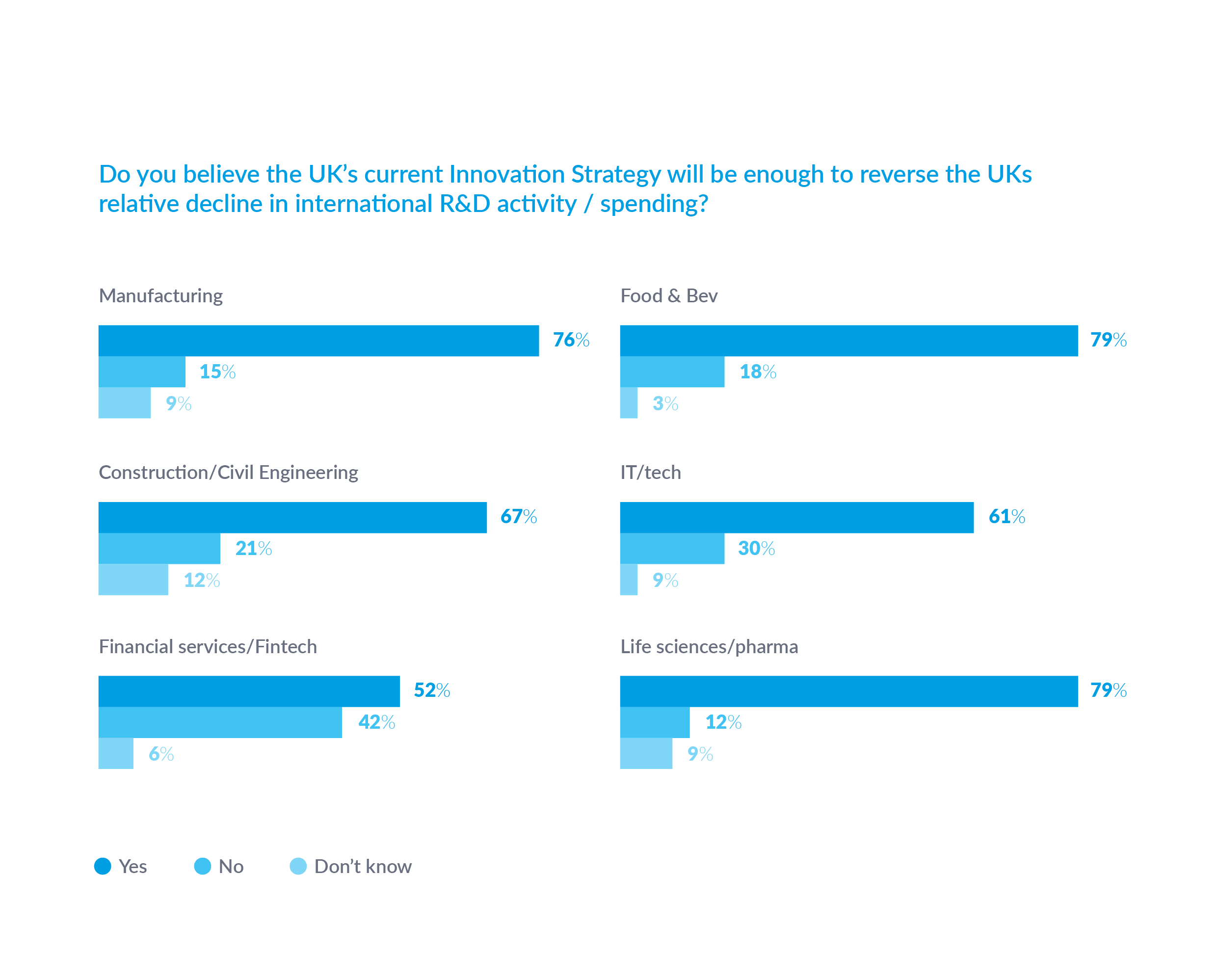

- Majority have faith in UK Innovation Strategy: 69% of respondents believe the Innovation Strategy will be enough to reverse the UK’s relative decline in international R&D activity and spending. 30% can increase claims due to recent expansion to cloud, data and pure maths while 26% have used UK’s new high-skilled Visa.

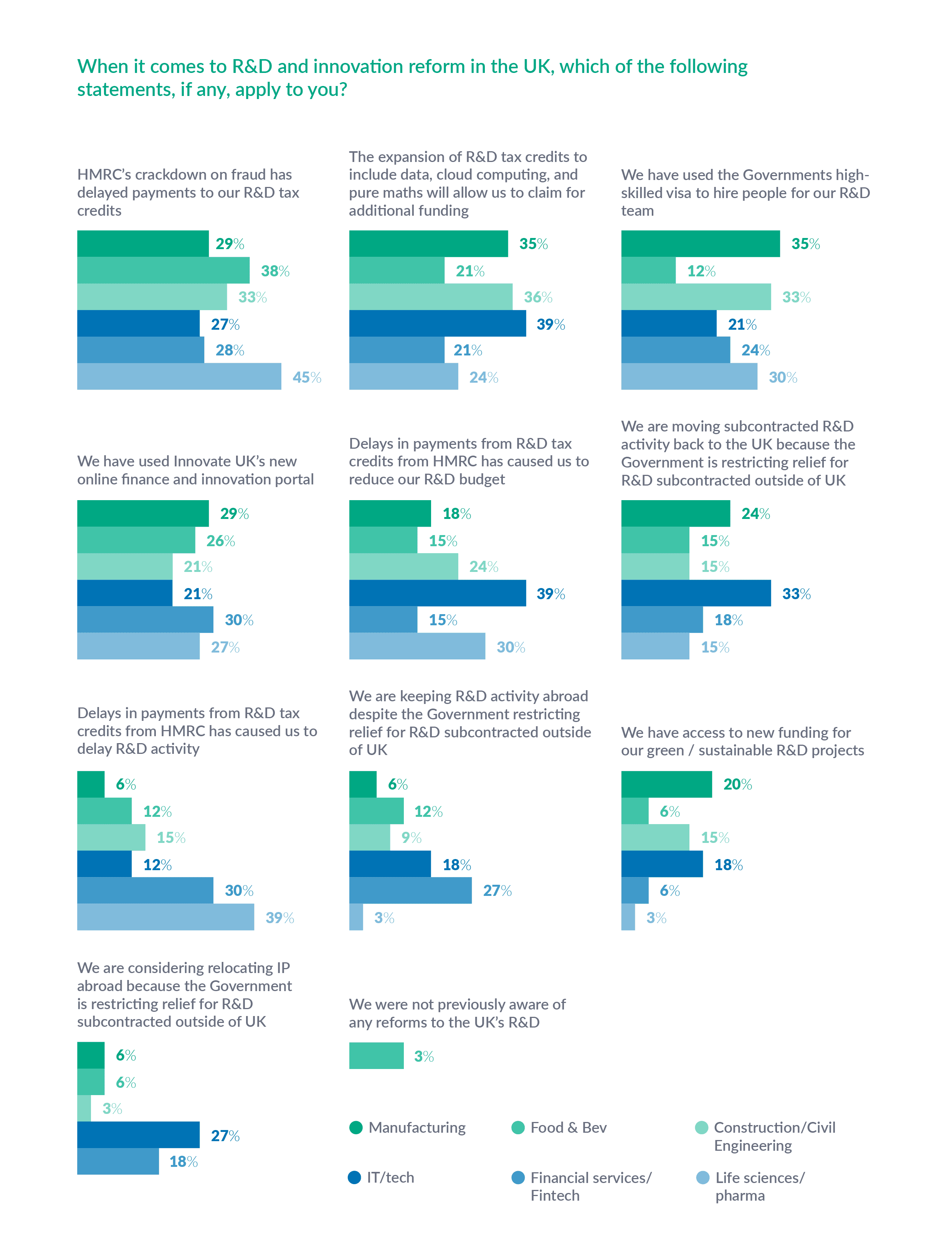

- HMRC fraud clampdown causing problems: 35% per cent of respondents reported that HMRC’s clampdown has delayed payments of R&D tax credits, 24% share that these delays have forced them to reduce their R&D budget, and 19% say that the delays have held up R&D activity.

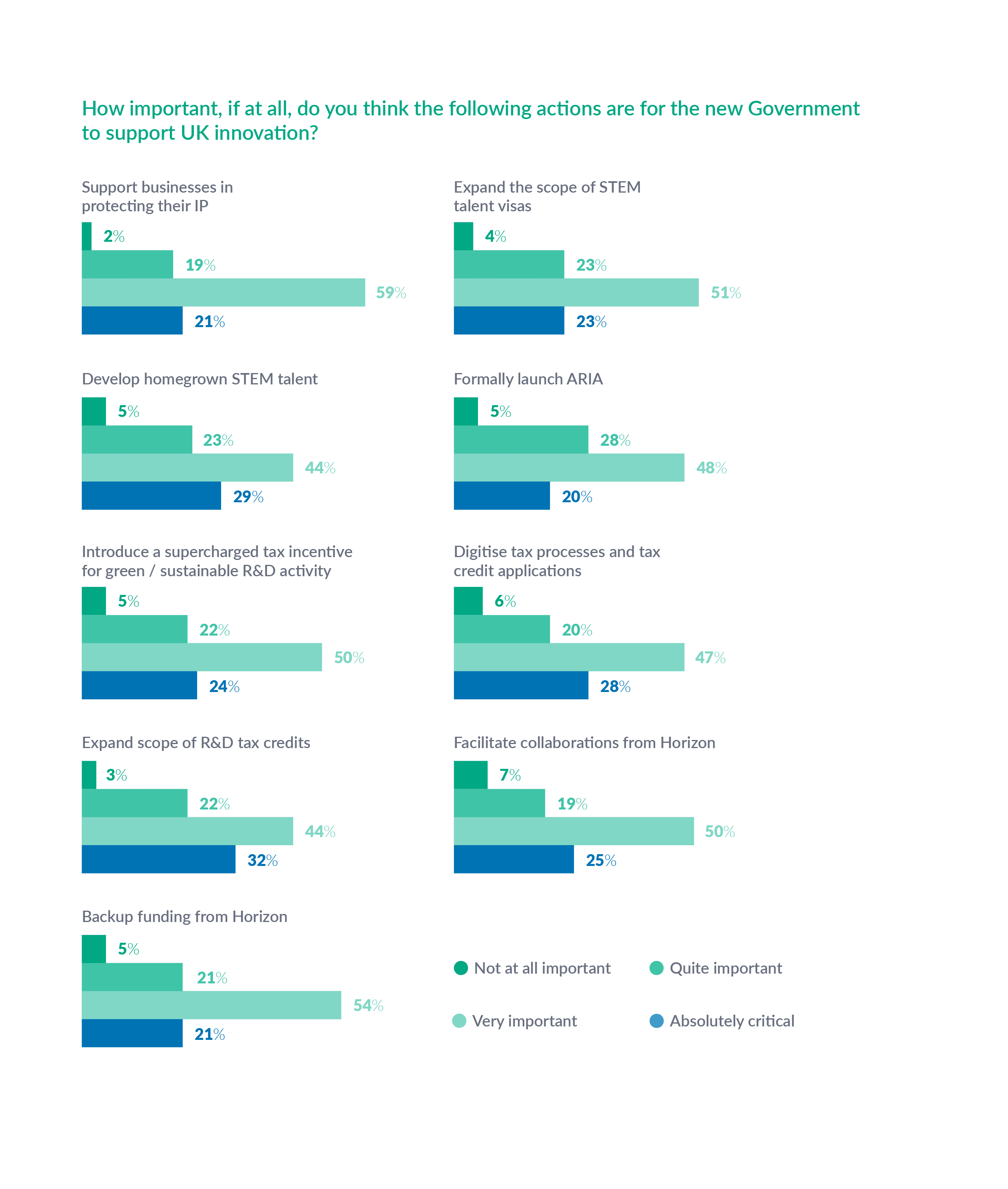

- Government must back up Horizon funding: 75% of respondents agreed that establishing back-up funding to Horizon was at least very important, with over one-in-five citing it as absolutely critical.

- ARIA seen as critical to future of UK innovation: Businesses eager to see ARIA come to fruition, with 48% believing ARIA to be very important to the future of UK innovation, and 20% consider it to be absolutely critical.

- Overwhelming support for new green R&D tax credit: There is significant support for a supercharged tax incentive for sustainable R&D activity.

- 95% said it was important, with half of total respondents saying it is very important.

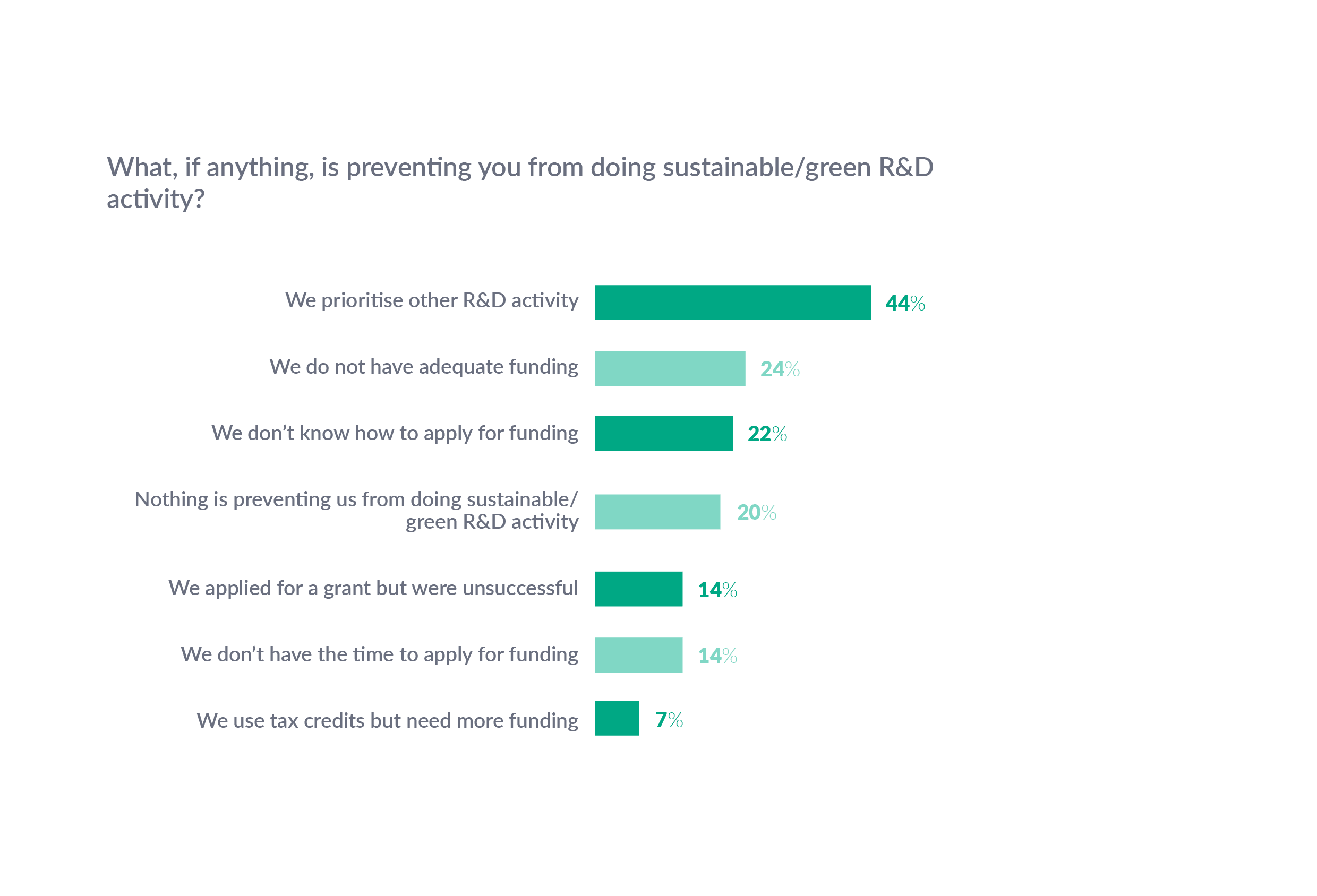

- UK businesses failing on green R&D: 80% of businesses are not investing in sustainable/green R&D projects. As for why, 43% are prioritising other R&D activity, 24% have insufficient funding, while 22% say they don’t know how to apply for funding.

We hope you find this report valuable. For further information or to find out how Ayming can help your business meet its R&D and innovation objectives, please contact us at: contactuk@ayming.com

Research Methodology

Between 7-11th November 2022, Ayming conducted a survey of 200 senior innovation, finance, tax, and CEOs/MDs in the UK. Survey respondents are all at CXO, director or head of department level, and evenly split across SMEs(companies with 250 employees or fewer) and larger companies. Those surveyed span across 6 sectors: manufacturing, IT and technology, construction and civil engineering, life sciences and pharmaceuticals, food and beverages, financial services and fintech. The splits between the sectors are all equal.

Chapter 1 – The Innovation Landscape

Amidst unparalleled domestic political turbulence, the UK’s emphasis on the importance of innovation has remained a notable constant. And as a result, whilst economic pressures put a strain on funding options, confidence in the UK’s Innovation Strategy is high.

However, unintended consequences of HMRC’s clampdown on fraudulent tax claims, and slashing of the SME scheme are starting to build a concerning picture for the future of R&D.

Budget Confidence

The majority of firms have experienced a positive change to their R&D budgets, with 54 per cent of respondents reporting an increase in the last year. Given the challenging economic conditions, it’s encouraging that most businesses have felt able to continue prioritising innovation.

Mark Smith, Partner of R&D Incentives and Grants at Ayming UK comments,

The number of firms increasing their R&D budget is indicative of a rebalancing of priorities we’re seeing right across the UK. Previously, R&D has been viewed as a nice- to-have discretionary spending avenue and during periods of economic uncertainty budgets have suffered as a result.”

And looking ahead, when asked if firms expect their R&D budget to increase next year, a further 12 per cent answered that they do, reflecting a robust continuation of this positive trend. This is then reinforced by a three-point drop in the number of firms expecting their budget to decrease next year down to 20 per cent.

Benjamin Craig, Associate Director of R&D Tax Incentives at Ayming UK, adds context, “As businesses begin to recover fully from the impact of the pandemic, it isn’t a surprise to see that most R&D budgets are increasing again. Where firms may have been forced to cut back in 2020, we’re now beginning to see a return to pre-pandemic funding norms.”

For SME businesses, confidence is soaring even higher, with 69 per cent of respondents with fewer than 250 employees expecting their R&D budget to increase next year.

Njy Rios, Director R&D Incentives at Ayming UK, raises her concerns, “With the Chancellor’s 2022 Autumn Statement making significant cuts to R&D tax relief for SMEs, this optimism might well turn out to be misplaced. As small and medium businesses plan for future R&D activity, they will have to consider the additional cost of innovation once their current benefits are reduced.”

As you might expect, different sectors have varying confidence levels going into next year. The food and beverage sector is revealed to be the least optimistic with 35 per cent of respondents expecting their budgets to be cut, 20 points higher than the average. There are many possible reasons for the sector’s faltering confidence, chief of which is the impact of the conflict in Ukraine on the cost of raw materials.

The UK’s food and beverage industry relies on the importation of wheat, oil and other related products from Ukraine and soaring prices have left many with no choice but to plan to economise wherever possible next year.

Craig adds,

The food and beverage sector in the UK has been under significant strain since it began to feel the effects of the labour shortage following Brexit. When you add onto that the worst cost-of-living crisis for a generation, which is significantlycurtailing consumers’ spending habits, it’s not surprising the industry is running low on optimism.”

As for the buoyancy of other sectors, the manufacturing industry is the most confident with 88 per cent of respondents anticipating an increase to their R&D budget next year, closely followed by the pharma sector, where 73 per cent are counting on an expansion of their current budget.

Given the dire economic backdrop, the fact that two thirds of respondents expect their budgets to increase next year strongly suggests that more firms are starting to equate strong and long-term economic growth with investment in new innovation and therefore view their R&D budget as a strategic priority.

The Who, What and Where of R&D

When it comes to the resources and partners that respondents are using to carry out R&D, the results are evenly spread, reflecting the wide range of ser- vices available to businesses in the UK.

In terms of what people are using for R&D, the most popular option – with 39 per cent of respondents selecting it – is artificial intelligence.

Smith remarks, “The popularity of artificial intelligence as a resource to facili- tate R&D is a reflection of the technology reaching a level of maturity that has allowed it to enter the mainstream. The basic hurdles in the technology have been cleared and now businesses are asking themselves how they can take full advantage.”

The growing prevalence of artificial intelligence technology within the R&D pro- cess represents the essential cycle of R&D, whereby earlier innovations breed new and greater innovations in turn.

In terms of who firms are working with to carry out their R&D, one third of respondents are collaborating with universities. Raising this number is an impor- tant objective for the CBI, which believes universities and businesses could be cooperating better to stimulate greater innovation in the UK.

Charlotte Kelly, Policy Advisor in Innovation at the CBI, comments that

In order for the UK to reach the level of innovation required to stimulate real growth, businesses and universities must work more closely together. As the home to some of the best universities in the world, the UK presents valuable opportunitiesfor businesses that are able and willing to collaborate.”

And when it comes to collaboration, the manufacturing sector outstrips other industries, with 37 per cent of respondents identifying collaborating with partner organisations as an avenue for R&D, ten points higher than the average. This is likely due to the fact that the industry by its nature is reliant on partnerships with other parties across the supply chain.

Craig comments, “The manufacturing sector is uniquely placed to innovate collaboratively, driven by its need to work with third parties up and down the entire supply chain. No manufacturers these days are responsible for the entire process from raw material selection to consumer product, which can make the process of innovation more challenging.”

As for the ‘where’, 69 per cent of businesses have moved R&D activity abroad in the last year and 70 per cent plan to do so next year. The US and Germany are the most popular destinations for moving R&D, taking 28 and 27 per cent of the share of responses respectively.

The dominance of these countries can partly be explained by the fact that both are considered big markets for innovation, the US in particular, whereas Germany has more recently launched its R&D tax scheme but is fast becoming a hub for new innovation in Europe. And the problem looks likely to persist, with the number of respondents planning to keep R&D in the UK dropping from 31 to 30 per cent next year.

Rios states, “The problem is one of perception. If the UK is to become the “Science Superpower” this government is striving for, then it must start to compete with the likes of the US and Germany, or risk losing out on the best talent.”

If not, the problem can become a self-perpetuating cycle. Innovation will continue to be offshored to where access to capital and talent is easiest, leading the markets there to become stronger and, in turn, draw more interest from other less successful regions.

The German market is particularly attractive to the pharma industry. It’s the destination of choice for 52 per cent of respondents who have offshored their R&D, with a further 36 per cent in the sector planning to move activity there next year.

For the sector, the temptation of opportunities available in the German market is significant. Rios qualifies this adding that, “We’ve already seen businesses and researchers in the biochemistry field move activity to Germany to guarantee their access to Horizon funding.”

Looking at what is influencing businesses, there is a particularly even spread of results, suggesting that the decision to offshore is based on a combination of four equally important considerations without one singular catalyst.

Thirty-seven per cent of respondents hail private funding opportunities as an influencing factor, 36 per cent put it down to a more favourable R&D tax credit scheme, 35 per cent cite better access to talent and 33 per cent specify grant funding opportunities.

All of which point to the fact that the UK might not be competing to the standard required for it to effectively work towards achieving its status as a “Science Superpower.”

Smith ventures, “There are a number of strong indicators here that need to be taken notice of. Each factor needs to be looked at in turn and changes will be required to increase the attractiveness of the UK as a place to do R&D.”

The UK’s Innovation Strategy

Whilst firms are appraising overseas options for R&D, the UK government has kept the role of innovation firmly in the policy spotlight.

Since the publication of its Innovation Strategy in 2021, the focus on boosting innovation has remained a key priority, bolstered by new funding commitments that will enter the market later down the line. And in spite of inflationary pressures, resolve to keep innovation at the heart of growth plans has not wavered.

It perhaps isn’t surprising therefore that 69 per cent of respondents believe the UK’s current Innovation Strategy will be enough to reverse its relative decline in international R&D activity and spending. An overwhelming show of support, particularly driven by the pharma, manufacturing and food and beverage sectors, where almost eight-in-ten answered in the affirmative.

Rios suggests,

With a government that is so consistently emphasising the importance of innovation for the future of the country and backing that sentiment up with investment –for larger businesses at least – it’s not surprising to see that positivity reflected back by the public.”

Considerably less convinced of its impact is the financial services sector, where 43 per cent of respondents do not believe the strategy will do enough to raise the UK’s international status.

Smith ascribes the sector’s doubt to the impact of its relative isolation from the rest of Europe, reflecting, “With news landing that the Paris stock exchange has overtaken London as the most valuable stock market in Europe for the first time since records began, the sector’s confidence was bound to take a knock – intensified by the lack of domestic fiscal stability recently, which will also be a major driver of this deficit in confidence.”

However, in spite of the widespread support of the current Innovation Strategy, when looking at the impact of reforms to innovation and R&D in the UK, a concerning theme emerges.

Across the industry, fraudulent R&D tax claims are widely agreed to be a damaging drawback of the scheme that must be confronted and HMRC’s subsequent clampdown an inevitable repercussion. However, the unintended consequences of this additional compliance are having a significant negative impact on those carrying out legitimate R&D. Thirty-five per cent of respondents reported that HMRC’s clampdown has delayed payments of R&D tax credits, 24 per cent share that these delays have forced them to reduce their R&D budget, and 19 per cent note that the delays have had an adverse knock- on effect on how quickly their R&D activity can be carried out.

Craig points out that, “The tax scheme is supposed to be an incentive. Whilst everyone is agreed that those filing fraudulent claims must be rooted out, HMRC needs to recognise the causal sequence its actions have begun and the impact they’re having on new innovation. We know of businesses that have decided against even filing a claim having heard the rumours of delay. Small businesses operating on tighter margins just can’t risk the wait.”

In Summary

The UK’s innovation landscape is in a positive position with confidence up in spite of the turbulent political and economic climate. But in order to achieve its status as a “Science Superpower”, more must be done to increase the attractiveness of the UK as a go-to destination for R&D.

Chapter 2 – Looking Ahead

As the UK tries to develop a more competitive market for innovation, businesses are starting to think about the future. But with a rapidly evolving energy crisis impacting how firms

approach sustainability, new incentives are required to support them in prioritising green R&D.

The UK’s R&D tax scheme was first introduced at the turn of the millennium and has been a strong driver of innovation across the British economy for over 20 years.

When asked if they believe whether the expansion of the current scope of credits is important, nearly a third of respondents answered that it was

absolutely critical, a higher proportion than across any of the other proposed reforms. A further 44 per cent defined it as very important, meaning that more than three quarters of respondents believe the expansion of the current system would be valuable.

This is particularly driven by the manufacturing sector, where almost half – 47 per cent – of respondents argued that this action was absolutely critical.

Craig questions whether this has something to do with earlier reforms made in 2015, stating, “We know the manufacturing sector was badly hit by changes made to the scheme regarding what materials could be included in a claim, which resulted in the value of their applications dropping quite significantly. In spite

of wider support for capital intensive industries like manufacturing, it would be apt to see the hire of plant machinery, equipment and premises included in new reforms to the programme, as these are all important components of the overall R&D process. The government needs a coordinated approach to spurring innovation, productivity and sustainability progress in the manufacturing sector.”

Seventy-six per cent of SME respondents identified the expansion of the scope of R&D tax credits as at least very important, but the Chancellor’s decision to curtail the scheme for SMEs leaves the future for these firms uncertain. And ambiguity over reforms that reduce the value of the scheme for small businesses will have an immediate impact on the output of innovation.

Smith points out that “The reason the SME programme has had sustained success is due to the perceived stability of it until now. Whereas previously it was a nice bonus, now you see it discussed at board level and businesses have embraced and embedded the process into annual plans. It’s been a reliable source of funding that SMEs wanted to see expanded, not axed.”

He continues, “Confidence in the programme has been steadily building for years, allowing businesses to incorporate the funding into long-term plans and we’ve noticed it starting to influence R&D decisions for our clients in a substantial way. You can’t turn that kind of confidence off and on again like a tap. Any ambiguity around it could have serious ramifications for its credibility going forward.”

A Problem on the Horizon

Ambiguity around the UK’s access to the Horizon Programme has also been identified as an area that needs addressing. Since the Brexit referendum in 2016, the dialogue surrounding Britain’s ongoing involvement in the EU’s flagship research programme, Horizon Europe, has been fraught – and the subject of numerous U-turns.

Having negotiated the UK’s access to Horizon funding in the Brexit deal, the decision was taken in July to block UK research programmes from applying. The result has been widespread confusion and panic for scientists based in the UK who rely on funding allocated from Horizon.

It is therefore unsurprising that 75 per cent of respondents agreed that establishing back-up funding to Horizon was at least very important, with over one-in-five citing it as absolutely critical.

Rios comments,

In being left out of Horizon, the UK stands to lose an estimated £14 billion in funding. And it’s clear that businesses need reassurance that the funding gap will be filled. Ambiguity during times ofacute economic challenge will result in an unwanted drop in activity.”

Interestingly, the same proportion of respondents agree that facilitating collaborations with Horizon is at minimum very important with more – as many as one-in-four – stating that this is absolutely critical.

Rios continues, “The problem with Horizon goes deeper than the funding. It’s also about participating in cutting edge R&D and collaborating with multi- national partners and experts to solve the biggest challenges facing the world as a whole. For UK innovation to be part of the solution, cross-border collaboration with other countries is a must.”

Unsurprisingly, the manufacturing sector, which – as identified in our first chapter – relies heavily on collaboration across its entire supply chain, is particularly driving this push for collaboration with Horizon with 88 per cent citing the facilitation of this as at least very important.

Smith remarks, “If the UK is to succeed in its attempt to establish itself as a science superpower, collaborations with regional research programmes like Horizon will be a valuable booster and certainly raise its international reputation.”

Failure to Launch

While respondents urge for funding from Horizon to be replaced, questions have also arisen about the centrepiece of the UK’s own funding programme – the Advanced Research and Invention Agency, or ARIA.

ARIA was launched in February 2021 with the ambition of funding high-risk, high-reward science and innovation across the UK with minimal bureaucracy. But progress has been slow. It took 12 months to name a Chief Executive to lead the formation of the agency, who then withdrew from the post before starting. Four months later, a new Chief Executive and Chairman were named, and plans are now progressing for ARIA to begin its important work.

Respondents are eager to see the formal launch of ARIA and believe this to be an important step for the Government to support new innovation in the UK.

Over a quarter deem its formal launch to be of moderate importance, 48 per cent believe it to be very important, and one-in-five consider it to be absolutely critical. Overwhelming support for the formalisation of the agency underscores the urgent need for its services.

Smith notes,

Across the UK’s R&D sector, the creation of ARIA was met with widespread positivity, but its lethargic pace has been deflating,so it’s no surprise to see that 95 per cent of respondents regard its formal launch as important. Firms are looking for new avenues to support the Government’sambitions to increase funding to the sector, and one of ARIA’s primary purposes wasto provide a system that could allocate it quickly.”

The sectors particularly calling for its formalisation are the pharma and financial services industries, where 79 per cent of respondents in each sector see it as being a very important part of how the Government can support new UK innovation.

Whereas by contrast, in the food and beverage sector this percentage drops to just over half. The sector disparity is likely representative of the opportunities each industry is expecting to garner from the formalisation of the agency, which is greater within the pharma and financial services sectors due to the nature of the R&D they carry out.

With the UK’s status as a Science Superpower a major objective for this Government, the prompt formalisation of ARIA should be a priority.

Leaning Green

If one of the Government’s key priorities is raising the UK’s international reputation for innovation, another is to become a global leader in the sustainable transition – and there is significant overlap between the two.

As businesses look ahead to the future of their R&D, many have begun to recognise that investing in green and sustainable innovation will accelerate their plans whilst contributing to a positive end-goal, whether it be lowering carbon emissions, reducing waste, or developing energy alternatives.

When asked to rank the importance of introducing a supercharged tax incentive for sustainable R&D activity, almost a quarter of respondents said it was absolutely critical and half described it as very important. The findings reflect the increasing awareness of businesses across the UK that green innovation is important, but equally that a greater incentive is required to drive momentum.

Seventy-eight per cent of SMEs view the introduction of a sustainable R&D tax credit at least very important, four points higher than the average for businesses of all sizes.

Rios comments,

It’s encouraging to see green R&D is perceived as similarly important to initiatives like ARIA, or securing back-up funding for Horizon to support the UK’s innovation. But it’s essential to note that small businesses cannot afford to invest in green R&D without additional support and incentive.”

Breaking down the results by sector: the construction sector is most eager to see the introduction of a specific sustainability tax incentive with 30 per cent of the industry identifying it as absolutely critical. In contrast to 18 per cent of the pharma sector, 21 per cent of those working in the food and beverage industry, and 24 per cent of both the IT and technology sector and the manufacturing industry.

Craig puts the construction sector’s enthusiasm down to the pressure its under to become more sustainable, stating “The construction sector uses a lot of heavy diesel-driven plant, and concrete is a very carbon-intensive product. In the last few years, we’ve seen the industry make efforts to adapt machinery to be less polluting, and a big push towards achieving carbon neutral status. So, the sector stands to benefit substantially from a specific sustainability tax incentive.”

Rios adds, “I work with some large construction firms whose sustainability teams have grown from two or three people two years ago, to close to 20 now, which reflects how much the sector is prioritising the sustainable transition.”

The factors preventing businesses from carrying out sustainable R&D activity suggest more emphasis needs to be placed on its importance. With 44 per cent of respondents prioritising other R&D activity, it’s clear that more needs to be done to make the commercial value of carrying out green R&D more competitive.

Twenty-four per cent identify insufficient funding as the reason they’re unable to carry out sustainable R&D. And a further seven per cent use tax credits but need more funding before they can prioritise green R&D.

A third of the technology sector specified a lack of funding as the reason it can’t focus on sustainable R&D, almost ten points higher than the average. And as an energy-intensive industry that needs to develop sustainable solutions, it’s concerning that inadequate funding is predominantly what’s holding the industry back.

Only 23 per cent of SMEs name inadequate funding as the problem preventing them from carrying out green R&D. But with plans set to significantly reduce the value of the SME tax scheme, the likelihood is that this figure will rise

rather than fall in the months ahead. And as the UK strives towards its Net Zero targets, it must find a way to encourage businesses of all sizes to contribute to new sustainably driven innovations.

Smith observes,

Progress on green innovation could end up a casualty of the UK’s recession unless a new way to incentivise businesses to take a long-term view is established.”

Closing Thoughts

The innovation landscape in the UK has been steadily maturing for years and remains in a strong place, underscored by the growing stability of the R&D schemes. But the government risks derailing this progress with the cuts to the SME scheme announced in the Chancellor’s Autumn Statement.In order for Britain to continue competing at the highest level with other markets, it must prioritise the development and reform of its various funding avenues and develop a coordinated approach to spur innovation, productivity and sustainability progress. Equivalent funding alternatives to the Horizon Programme, the formal launch of ARIA and the introduction of an advanced sustainable R&D tax incentive are all actions that will provide businesses with the right level of support to sustain new innovation into the future.