Table of contents

Forward

The last couple of years have been turbulent. dive into the impact of Covid-19 on inno adaptation in both processes and funding.

One year later and the world economy is gr energy crisis. Costs were already rising due inflation and supply chain disruption. But the prices has threatened the very survival of profitable. In reaction, companies are now their energy consumption and overall

The situation has fascinating – and potentially sustainability. Whereas energy-cutting

by altruistic goals, that has completely now commercial, which could drastically fossil fuels. For a long time, businesses have radical innovation will have the biggest

or fossil fuel dependent industries.

The problem is these type of wholescale Therefore, governments have to step up and businesses with the funding they need to introducing new mechanisms where needed. would be significant.

Last year’s Barometer highlighted the need crisis – a fact that the last couple of years ha through which businesses navigate turbulence the architects of positive change.

I hope you find this year’s Barometer an insightful and useful resource.

Hervé Amar

President, Ayming Group

Methodology

This report, our fourth annual International Innovation Barometer, builds on our analysis of R&D over the last three years. For this, we have surveyed 846 R&D and innovation directors, Chief Financial Officers, Chief Executive Officers, and business owners, up from 585 last year.

Our findings are split into three sections analysing specific areas: the first two sections focus on the innovation landscape and financing, whilst the third section this year examines the impact of the current energy crisis on a firm’s ability to innovate. Questions for the first two sections remain consistent with previous surveys to allow for year-on-year comparisons to be drawn and trends identified.

These findings have then been analysed by the following members of Ayming’s senior management team

Our respondents are from the following 17 countries, with Hungary, Singapore and China added to the research from last year’s report.

Summary and Key Findings

The Innovation Landscape

Up 4% on last year, businesses are marginally more confident that they are doing enough innovation. However, this is still down 10% from prior to the pandemic.

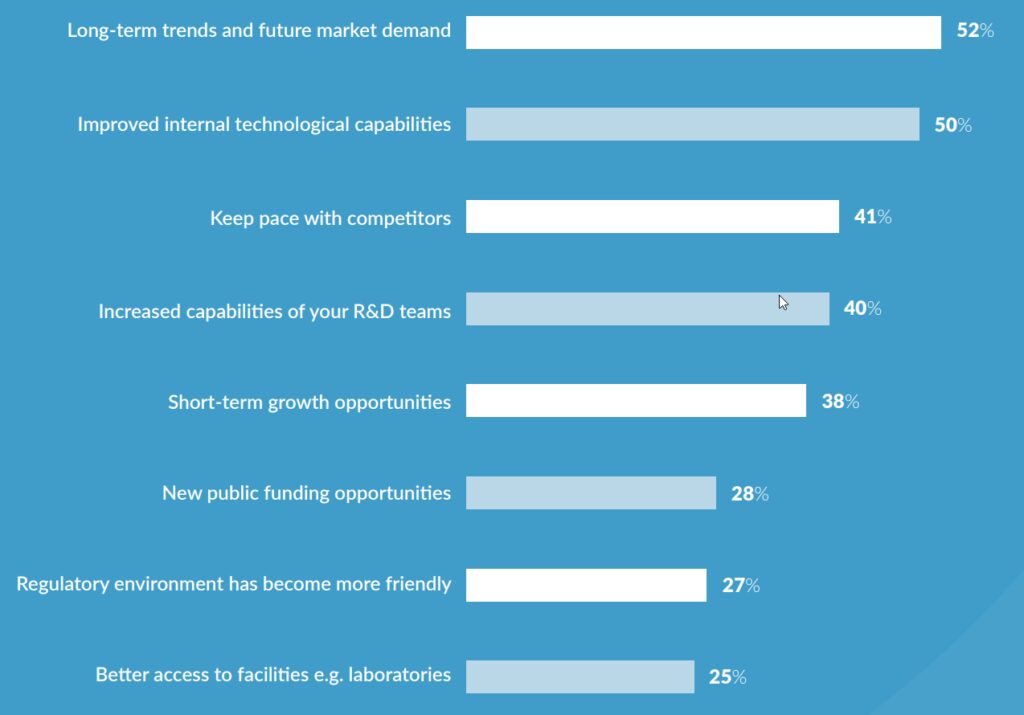

While the pandemic forced companies to pivot quickly to the short term, the initial shock has subsided, and people are thinking about their direction with long term trends the most popular driver of innovation selected by 52% of businesses.

While last year, firms took R&D in-house, this year has seen a 10% decline in internal resources, a 3% rise in external public resources, and 15% rise in external private resources.

Most likely due to travel complications, the number of firms only innovating internationally is up 5% on last year, which is still short of pre-pandemic levels.

The most popular location for innovation abroad is the USA, followed by the UK and Germany.

Up 2% this year, availability of talent remains the most popular influence on where businesses do R&D abroad, 8% ahead of the next most popular influence, tax credits.

Financing Innovation

The majority of innovation remains self-funded, but tax credits have risen 2% and extended their lead on grants, which are down 8% nationally and 3% internationally.

Private funding has had a renaissance, with equity debt funding up from 23% to 31% and crowdfunding up 7% to 15%.

The number of firms with a defined budget for R&D has risen from 77% to 84% while businesses without a defined budget has dropped 7%.

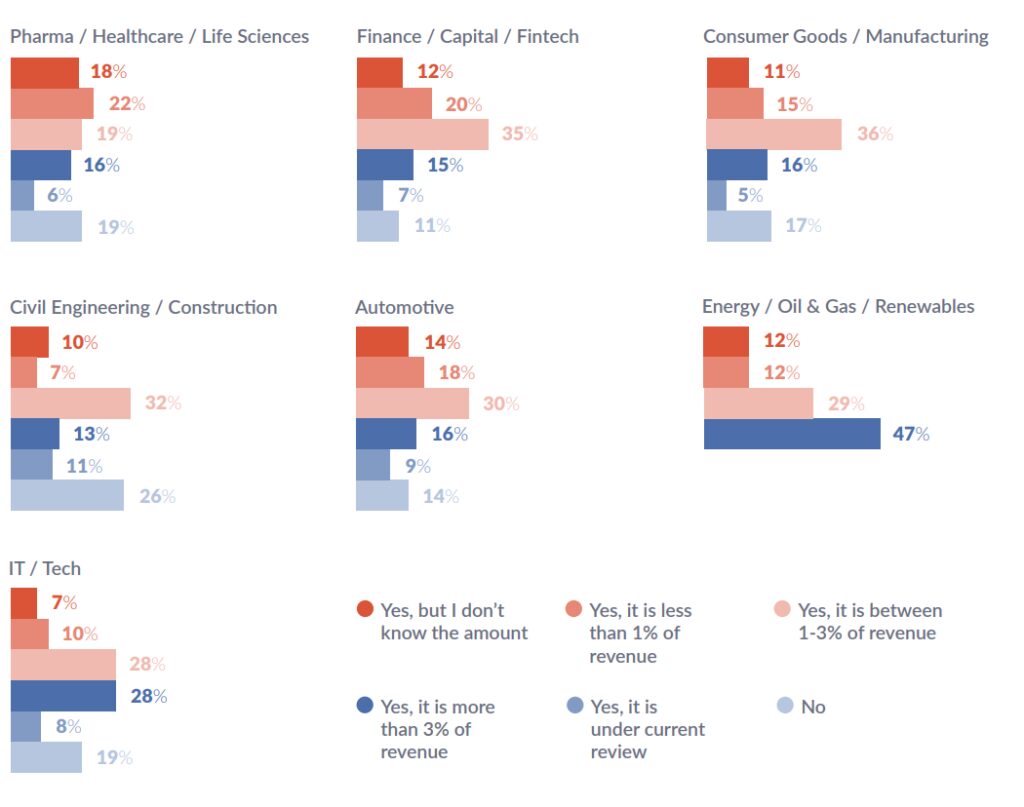

Although spending between 1 and 3% of revenue on R&D remains the most popular choice, the amount of firms spending more than 3% of revenue on R&D has increased to 18%.

Despite the increasingly bleak economic backdrop, 62% of businesses are expecting R&D budgets to increase, with 21% expecting the increase to be significant.

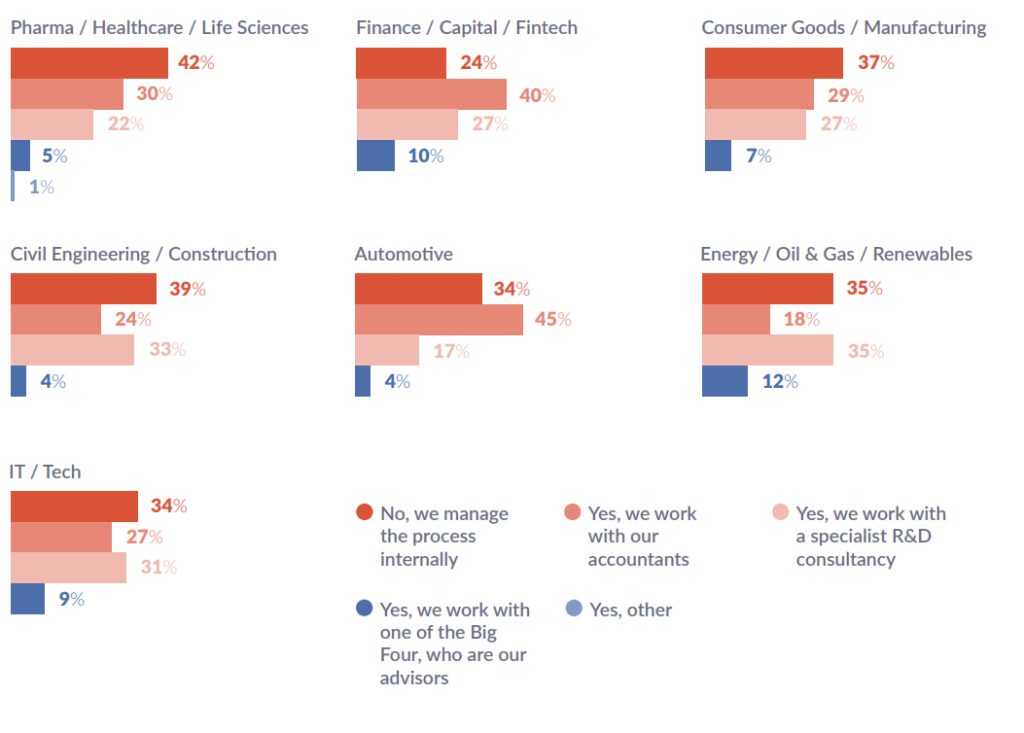

Securing funding internally has dropped 9% as firms opt to work more with use of accountants to secure funding up from 27% to 33%, and use of the Big Four to secure funding up from 5% to 7%.

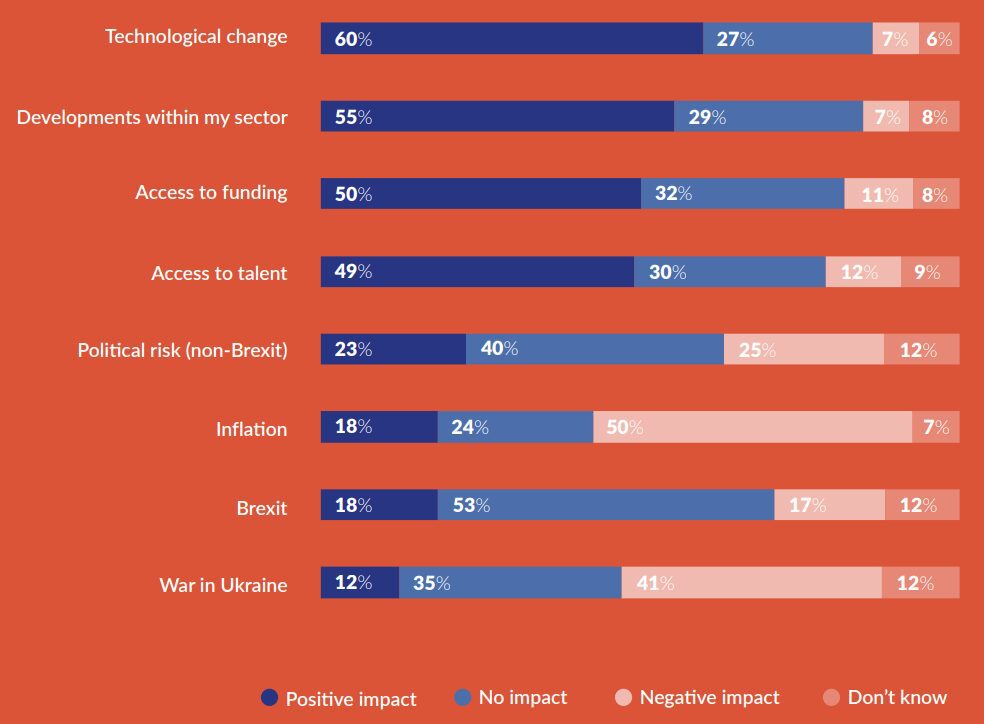

Technological change remains the most positive influence on R&D budgets as the benefits of technology continue to improve R&D outputs, while inflation is expected to have the most negative impact on R&D budgets.

The Energy Crisis

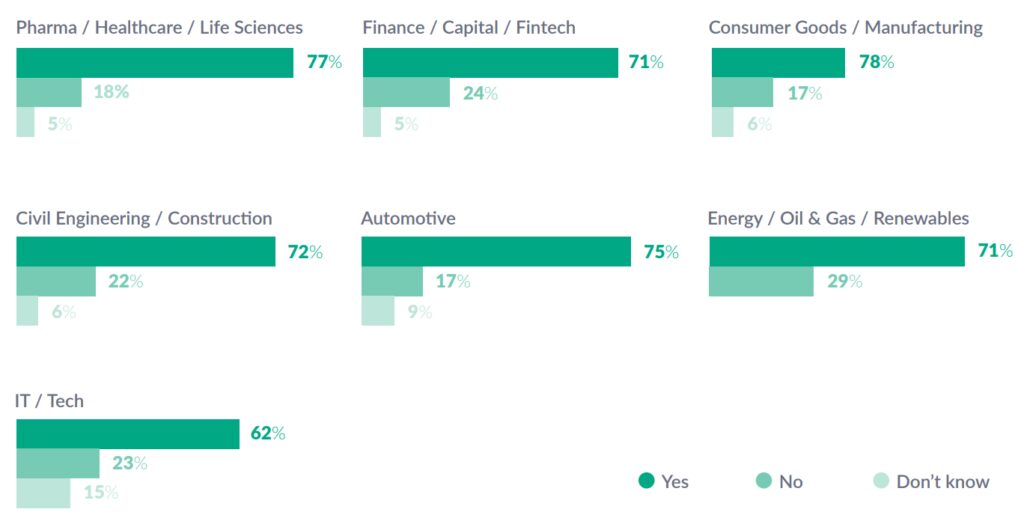

The rise in energy costs is having massive knock-on effects on profitability, with 72% of businesses reporting that the energy cost increase is affecting commercial success.

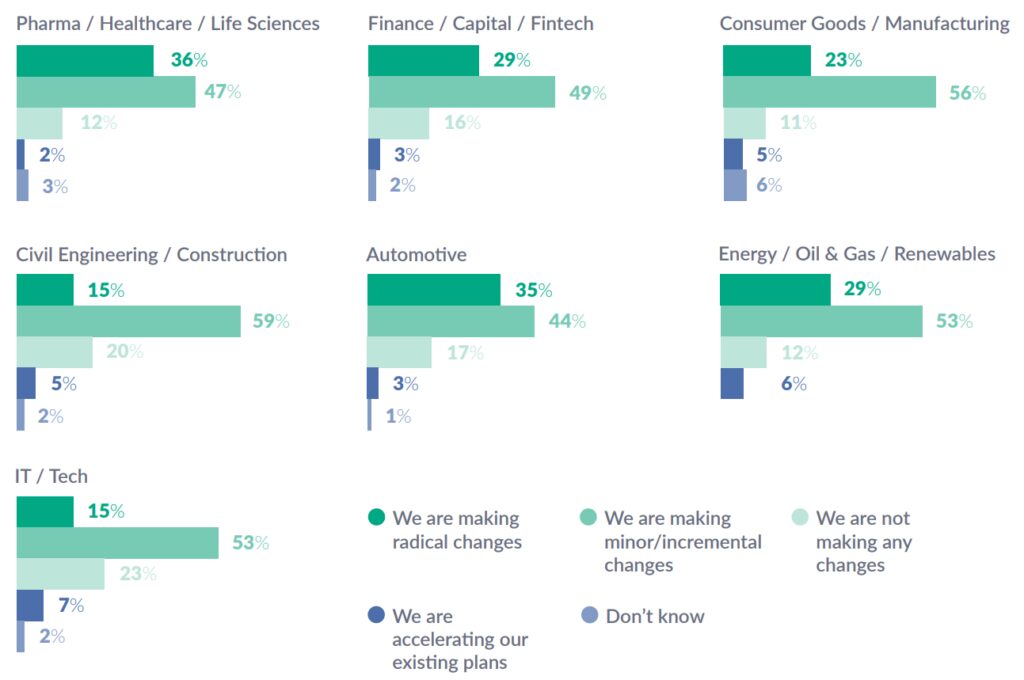

These pressures have jolted companies into action and 77% of firms are making changes to their business, with a quarter of all businesses saying those changes are radical.

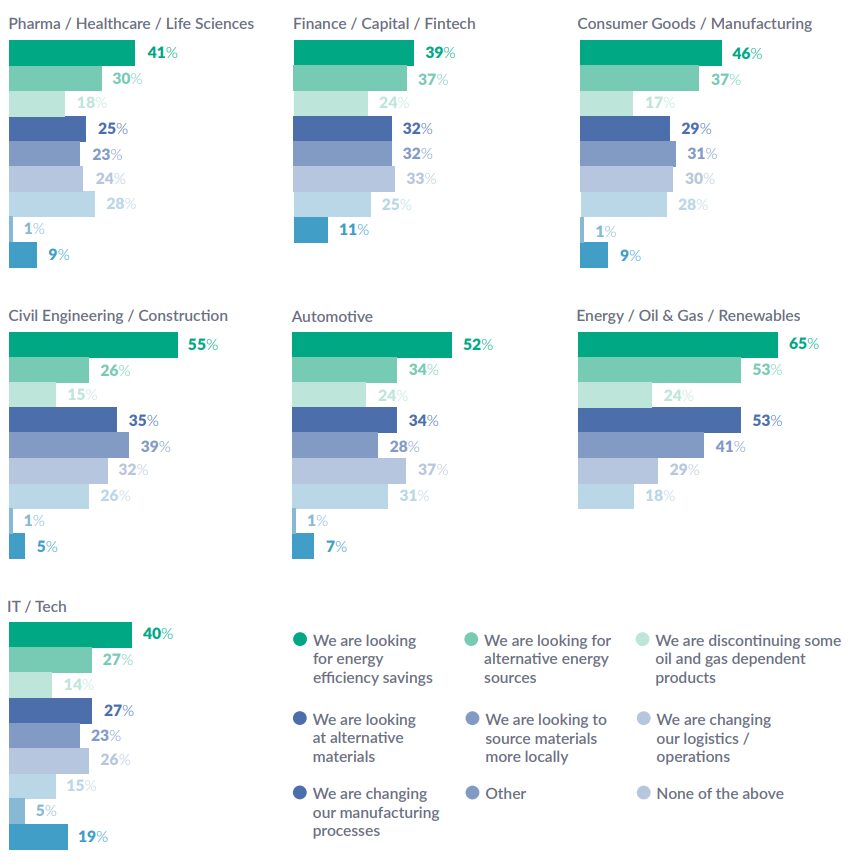

Positively, the costs are forcing companies towards greater sustainability. Used by 44% of businesses, the most popular tactic is looking for energy efficiency savings. This is followed by looking for alternative energy sources, which 33% of businesses are doing.

When asked if they believe they have sufficient funding from their governments, 52% of businesses say they do while 34% say they do not.

Governments have a responsibility to facilitate the transition and support companies to navigate the energy crisis with diverse funding and support mechanisms.

Section 1 – The Innovation Landscape

Last year’s IIB expressed hope to see a reversal of some of the trends from the pandemic.

Positively, this year has seen some return to pre-pandemic norms and sentiment, with a swing back in the findings around confidence, talent, outsourcing, and technological advancement.

However, the results are notably different to before the pandemic, indicating some of the changes may be more long term. After all, the initial shock of Covid-19 may be behind us, but we’re not out of the woods yet. The Great Resignation, inflation and economic headwinds are all challenges that businesses must navigate.

Post-pandemic confidence

As ever, our first question asks whether people are doing enough innovation. This year, respondents are marginally more confident, with three quarters of businesses saying they are doing enough innovation, up four per cent from last year. However, this is still down 10 per cent from prior to the pandemic and 20 per cent of firms say they are not doing enough innovation.

Covid-19 is still having an impact. Kate Johnson, Innovation Practice Manager at Ayming US, says,

We have seen COVID surges throughout Houston this year. Until we’re truly the other side of this pandemic, confidence levels are bound to be a bit lower.”

Does your organisation undertake enough innovation/research and development (R&D) work?

As one might expect, the sectors vary in confidence levels. Financial and energy firms are really confident, whereas construction firms are most likely to feel like they aren’t doing enough innovation.

“The construction sector was one of the hardest hit by Covid,” says Johnson.

Some projects were considered essential, but in a lot of areas, only true infrastructure projects were allowed to proceed. On the other hand, almost all financial companies could work from home, and the pandemic actually spurred a wave of digitalisationand innovation in the sector.”

However, the pandemic is not the only factor at play anymore. As we have emerged out of Covid-19, the repercussions have started to bite. The combination of inflation, energy costs, war in Ukraine, and general political

and economic turbulence will now be affecting confidence levels. As explained in last year’s report, innovation through turbulence is essential and this will inevitably be on the minds of businesses.

Most countries are grappling with inflation and various emerging crises. The US has just passed two enormous funding bills and China is experiencing a growing debt crisis. Mark Smith, Partner – Innovation Incentives at Ayming UK says,

In the UK, we’re in the middle of a cost- of-living crisis without a functioning Government. That instability makes it hard for people to know whether they’re doing enough, or what enough even is. If things are turbulent, they know in the back of their minds, they need to be innovating.”

Innovation motivations

Despite this turbulence, long term trends remain the biggest driver of innovation and, this year, people are less motivated by short term growth and less worried about competitors. R&D is naturally forward thinking but, the pandemic forced companies to pivot quickly based on the requirements and socio-economic changes of the pandemic, which stimulated short term

adaptation and competition for pandemic opportunities. Now that initial shock has subsided, people are reverting back to thinking about the direction of their business.

What are the main drivers for your R&D strategy?

– Three answers could be selected.

Johnson says, “As much as Covid’s still around, it’s a bit of chaos that we’re familiar with at this point. And ultimately there are all these new variables, like the war in Ukraine. You can’t keep jumping from one thing to the next. You have to take a step back, be strategic, work out where your company needs to go,

and focus on that.”

The biggest jump up this year – moving up to second place – is internal tech capabilities, selected by 50 per cent of respondents. This continues trends from the last few years wherein innovation benefits from significant advancements in technology.

In particular, the pandemic accelerated the transition to the cloud to further

support remote work. Johnson says,

Cloud computing is the norm now. But we used to rely on individual devices to house all of our information. We’re at a critical mass with some of the different computing technologies. Over time, you see patterns where new infrastructure comes out, and everyone rushes to implement them.”

The growing capabilities of AI are also now having a significant impact on R&D outputs. Smith says, “AI has had a huge impact in speeding things up in the pharma sector. DeepMind recently announced they have mapped every

protein known to science. That would have taken a lot longer without AI so the potential for it to accelerate scientific discovery really is limitless.”

Contrary to the growing influence of technology, regulation is consistently one of the least popular drivers of innovation strategy. When it comes to the relationship between regulation and innovation, regulation is more usually the boundary as opposed to the driver, depending on the sector.

For example, regulation has a big impact on energy, at 47 per cent, but a smaller impact on consumer goods, at 19 per cent. Johnson says, “The regulators have banned ingredients recently in the cosmetics industry, but companies in that sector already knew those ingredients were problematic and have anticipated that change by removing them from their products.”

Broadening resourcing horizons

When it comes to resources, businesses have broadened their horizons. While last year, firms took activity in-house, this year has seen a reduction in internal resources and a rise in external public and private resources as we have opened up from the pandemic.

What resources do you rely on for your innovation/R&D?

– Multiple answers possible

Although internal innovation has decreased 10 per cent, it remains the most popular option. It is after all very important to have a core R&D team to drive your strategy. Fabien Mathieu, Partner and Managing Director at Ayming France, says,

Most people have the project management and big picture stuff internally. They might do it in-house if it’s possible or cost- effective. But they’re much more likely to outsource some of the development.”

Given the rise in external relationships, you would expect collaboration to be up, but it has taken the biggest hit this year and is down from 44 per cent to 37 per cent. Smith says, “Collaborations can take a while to set up and get moving, so it may just be that people haven’t found the time yet. Otherwise, it might be that some people have found it easier not collaborating and they can be more agile.”

There are some big sector disparities. Collaboration is highest in the tech sector, but lowest among pharmaceuticals. Johnson explains, “In pharma, there is less incentive to collaborate because the first to market gets the patent and is able

to commercialise. Whereas in IT, there’s a lot of value in knowing what other people know. It can be very beneficial to both sides.”

The biggest increase has been among external private resources, which has shot up 15 per cent on last year from 29 per cent to 44 per cent, almost at pre- pandemic levels and with a notable boost from the financial sector.

Smith says, “The biggest reason for outsourcing is when you don’t have the resources internally. In finance, a lot of smaller fintech companies have sprung up offering to solve very specific problems in innovative and cost-effective ways.”

But this challenge goes beyond finance and the international R&D community continues to struggle with talent. Not only has the complexity of R&D increased, but so has the competition for R&D talent, especially now so many countries are feeling the pinch of The Great Resignation.

Outsourcing does come with advantages. Not anyone can write code, but anybody can write code from anywhere, allowing for offshoring and flexible working. Johnson says, “People in the pandemic gained some clarity on how they wanted to work and are more selective with the positions they’re taking. Tech talent in particular might favour work on contract over being an internal employee.”

Offshoring Innovation

When asked about offshoring, a combination of local and international remains the favoured option. This supports the above dynamic whereby the company develops the idea, and then looks for the most skilled and inexpensive labour for the project.

Of course, people offshore development work because of the expense, but there’s the benefit of people working while you sleep. Johnson says, “It can speed things up if you’re giving people data to crunch or code to write overnight.”

The number of firms only innovating internationally is up 5 per cent on last year, which is short of pre-pandemic levels. This most likely comes down to the ease of travel. The rules keep changing and people have to make decisions about setting up innovation based on whether there are any travel restrictions.

Johnson explains, “Some of our clients have facilities in China. They used to go over there around once a month, but between Covid and the rising cost, that doesn’t make sense anymore.”

Our figures have been pushed up by two of the new countries we have surveyed this year – Hungary and Singapore – which both have very high levels of international only innovation. Johnson says,

These are both smaller countries so they may need to look abroad to find the right talent or knowledge. They’re also both bordered by heavy innovators, allowing them to easily work with their neighbours.”

Looking at the sectors, the automotive industry is well above the average for innovating internationally at 16 per cent while the pharmaceutical sector leads the way at innovating locally at 54 per cent – almost 10 per cent above the average. These differences are driven by regulation. Smith says, “Innovating abroad is complicated in pharmaceuticals because regulation differs substantially from country to country, especially compared to the automotive industry, which is more universal and consistent.”

Push and pull factors

Digging deeper into offshoring innovation, we also asked our respondents what influences those crucial decisions to innovate abroad. The findings reflect the well-established fact that talent is increasingly critical to R&D. The most popular location for innovation abroad is the USA, which is technologically advanced and has a mature R&D landscape, followed by the UK and Germany.

Which of the following most influences where you decide to carry out your innovation?

Furthermore, availability of talent remains the most popular influence, up two per cent on last year at 47 per cent. Talent is especially important to the UK, Canada and China. The intense competition for talent and high staff turnovers in these countries is encouraging R&D leaders to look to new markets with greater stability of labour. Johnson says,

Team consistency is very desirable. Working with the same people is worth a lot because starting afresh is very time-consuming.”

Pharmaceutical firms are an outlier here. Although talent was most important to the pharmaceutical sector last year, it is now least important and pharmaceutical firms are instead motivated to innovate somewhere based on tax credits. This goes some way to explaining why tax credits have jumped up four per cent and extended their lead on grants.

Our respondents are right to value credits. Mathieu says, “Credits are an entitlement plan, so if you’re doing the qualified work, you’re entitled to the credits, versus grants which are on an application basis, so are time consuming and less certain. Ideally, the combination of both schemes is the most efficient way to finance a given R&D project.”

Section Conclusion

This last year has seen some reversal of the effects of the pandemic; confidence has risen, innovation is less insular, and offshoring is up. However, the landscape remains somewhat turbulent and R&D teams still have big challenges ahead.

To thrive in what is to come, innovation leaders must think cleverly about resourcing, implement technology effectively, and make use of all the available funding.

Section 2 – Financing Innovation

Whilst sky-rocketing inflation and a combination of domestic and international political turbulence sets an unsettling scene for the funding landscape, financing innovation remains a clear priority for businesses.

Amidst this increasing economic uncertainty businesses must maintain steady and sustainable innovation, but first they need to find the appropriate funding.

Unsurprisingly, the majority of innovation remains self-funded, with just over half of respondents opting to fund innovation this way.

The number of firms using national grants has dropped from second to fourth place, with R&D tax credits moving in behind self-funding as the next most popular source of financing innovation with a 36 per cent share of respondents.

Given the longer-term nature of grants as a source of funding, it’s not surprising to see a minor drop in usage and it’s unlikely this is a result of the funding stream drying up – we’re certainly not seeing changes of that kind within the UK market. But more than anything, it’s very positive to see more firms making use of the tax credits they’re entitled to”

Says Smith

“What I do find surprising however” Smith continues, “is the further drop in international grant funding from last year, given the next generation of €800 billion EU funding that has since entered the market and is currently available to allocate internationally.”

This could be due to the fact that there is still a huge amount of education to be done around tax credits internationally. In the UK, where knowledge of the scheme is widespread and the consultancy market is mature, uptake is still far off where it could be. In Germany, the scheme was only launched a two years ago, so people are less aware of it.

Of the US scheme, Johnson says,

Just about all the new clients we talk to haven’t heard of the R&D Tax Credit Scheme and didn’t know they qualified. The Government doesn’t promote it so it can feel like consultancies are the only ones raising awareness of it. It should be a collective mission to expand credits andpique people’s interest.”

Whilst fewer firms are using grants, both equity debt funding and crowdfunding jumped from 23 to 31 per cent and seven to 15 per cent respectively, establishing a much more even spread in responses this year. The hike in the number of respondents using crowdfunding is driven by the technologically shrewd fintech sector, 21 per cent of which is now using it as a significant

avenue for funding.

The construction sector is particularly hesitant to use public funding for innovation with only

22 per cent of respondents opting to finance innovation via R&D tax credits, well below the

36 per cent average, and placing last for grants and crowdfunding, with 60 per cent instead preferring to self-fund.

This isn’t surprising to Smith, who comments that “due to the type of innovation the construction sector undertakes, it can be less immediately obvious that public funding is aviable option in contrast to sectors where innovation involves a more stereotypical process of R&D, where research is carried out by white coated scientists in laboratories.”

“The consequence of these pre-conceived notions of innovation”, adds Smith “is that the construction sector has been slower on the uptake of R&D tax credits and other sources of public funding than other sectors. It’s absolutely essential that the sector makes better use of credits and diversifies its funding streams to innovate more successfully.”

Budget confidence up

With funding options diversifying, the number of firms with a defined budget for R&D has risen from 77 to 84 per cent, with businesses without a defined budget dropping a significant seven points.

Does your organisation have a defined budget for R&D?

This positive trend is particularly encouraging given the ongoing economic uncertainty, indicating that, in spite of less-than-ideal commercial conditions, funding innovation remains a significant priority for the vast majority of firms. Whilst spending between one and three per cent on R&D remains the most popular choice, up two points to 31 per cent, it’s promising that as many as 18 per cent of firms are spending more than three per cent of revenue on R&D. This is especially apparent within the energy sector, where 47 per cent of organisations have a defined R&D budget over three per cent.

According to Mathieu, Three per cent is a fairly substantial budget for R&D, so it’s tremendously encouraging to see even a marginal rise there amidst the current economic climate.”

However, with as many as 27 per cent of respondents in the construction sector lacking a defined budget for R&D, it’s clear the industry is comparatively struggling to prioritise R&D.

Procurement for construction projects more often than not comes down to the lowest cost bidder, meaning profit margins within the sector are tighter than most, contributing to a legacy of underinvestment and increased pressure on a sector that should have a far more fundamental role to play on the innovation stage.

Johnson says,

Energy usage, transport, and decarbonisation all require significant innovation within the construction sector. For instance, there are construction companies producing low-carbon concrete, but without stronger financial incentives, the sector is locked in a cycleof underfunding and ultimately won’t have the budget to dedicate to R&D.”

As far as other sectors go, whilst a fifth of financial firms currently spend less than one per cent of revenue on R&D, it’s the most optimistic industry with regards to its budget expectations for next year with an enormous 69 per cent of respondents indicating they expect their R&D budgets to increase. That positive trajectory is mirrored across all sectors, where on average, 63 per cent of firms are expecting to spend more on R&D next year, up six points from 2021, including as many as 36 per cent of pharmaceuticals firms and 44 per cent of construction firms.

Looking ahead, Mathieu adds, “I hope to see a drop in the number of firms spending less than one per cent on their R&D budget. But overall, it’s great to see more and more businesses setting aside a defined budget for R&D. Whilst the global economy stutters, innovation must remain a constant.”

In the next 3 years will your organisation’s R&D budget:

However, the number of firms expecting their R&D budget to take a hit going into next year has also gone up by a point to five per cent – likely influenced by the increasingly bleak economic backdrop.

Considering this, Smith warns against

the temptation during periods of economic headwind to tighten budgets by positioning budget for R&D as discretionary spending where costs can be cut.”

Seeking support

As confidence in budgets grows – in line with broader trends of business opening back up – we can see firms moving away from internal processes when applying for public funding.

Do you have external support to access funding for your innovation?

As pandemic-specific turbulence continues to subside, the number of respondents managing the process of applying for funding internally has dropped nine points to 33 per cent, although not quite to levels seen in 2020, suggesting the pandemic’s ripple effect continues to have an influence.

In less mature R&D consulting markets, such as Germany where, as we’ve mentioned, the scheme was only launched in 2020, it is unsurprising that as many as 13 per cent of firms are working with the Big Four, as specialist R&D consultants are unlikely to be so widely

accessible. Whereas across the UK’s considerably more mature R&D landscape, just three per cent of firms continue to work with the Big Four. But, as Mathieu points out, “The Big Four are always likely to retain a significant advantage in the market based on long-standing relationships on other practices and their brand name. However, as a new scheme develops, companies need R&D and Innovation specialists to support them.”

The future of financing

We’ve seen that budget confidence is up but in terms of factors driving that trend – for another year – technological change remains the most positive influence on R&D budgets, with conviction in its positive impact up one point to 60 per cent this year.

As AI capabilities and data tracking technologies rapidly develop, this will stimulate further R&D in the space, resulting in renewed investment in a continued cycle of innovation.

In terms of the factors that respondents believe will have a negative impact on their R&D budgets – unsurprisingly, the overwhelming response for 50 per cent of respondents was inflation. Particularly driven by 56 per cent of the IT and tech sectors, 54 per cent of the automotive industry and 52 per cent of the consumer and manufacturing sectors, all identifying inflation as their greatest concern.

With increases in budget effectively cancelled out by sky-rocketing inflation, firms hoping to push ahead will be left stationary, spending more to achieve less. Baked into the problem is the need for wage increases and the subsequent impact this will have on access to talent.

The most concerning problem, according to Smith is that the latest inflation crisis

coincides with one of the worst labour shortages the UK has seen in a generation. We know firms have identified access to talent as being critically important to successful R&D, so the onus is on businesses to pay people more in the short term to retain and attract the talent they want.”

However, as inflation causes the balance between labour and capital to shift, new criteria for investment could enable some businesses to take advantage of the economic turbulence. Seventeen per cent of respondents believe inflation could have a positive impact on R&D budgets, which whilst initially seeming counterintuitive, suggests opportunities for innovation will present themselves, particularly in the development of alternatives to commodities such as natural gas that are driving up the cost of living.

With ongoing conflict in Ukraine and tensions rising in the Far East, it is unsurprising that the share of respondents who believe political risk will have a negative impact on R&D is up five points to 25 per cent.

In the UK, domestic political turbulence has also triggered a wave uncertainty for businesses. With intentions to stick with long-standing policy decisions – such as the former Chancellor’s corporation rate hike – left ambiguous, businesses are being forced to guess the direction of travel.

Section conclusion

With new factors coming into play to undermine recently regained confidence, businesses have a challenging time ahead navigating solutions. One thing remains clear however, as economic and political uncertainty looms, businesses remain positive as does their intention to innovate.

Section 3 – The Energy Crisis

The War in Ukraine has massively disrupted energy markets. Global energy prices are now expected to jump by around 50 per cent in 2022 – the biggest rise since the 1970s.

Suddenly, an unavoidable cost has shot up, driving up the cost of production, raw materials, transport and even office bills.

But, as ever, necessity is the mother of invention. Businesses are having to rethink their energy consumption and implement significant changes that are pushing them in a decisively sustainable direction.

A sudden price shock

Businesses across all sectors are feeling the squeeze. Seventy-two per cent of businesses reported that the energy cost increase is affecting profitability. Predictably, the manufacturing sector is most at risk, with 77 per cent of firms expecting a hit to profitability.

On manufacturing, Mathieu says, “Not only do you have to run your machinery, but there are massive knock-on effects, from the cost of your raw materials, right through to the oil you use to grease your machinery.”

Will the rise in energy costs (and the associated costs), materially impact your profitability unless you cut costs?

The rise is so significant that it has rendered some business models unprofitable and therefore redundant. Johnson says, “Let’s say it costs a trucking company $2,500 to transport 30 tons of food. Now the cost has jumped 50 per cent, all the contracts you have lined up could generate a loss at the agreed rate. In a matter of weeks, you’ve gone from a reliable profit to losing money.”

Inevitably, these ripple effects impact some businesses more than others, leading to the surprising statistic that 21 per cent of companies say it won’t affect them. The technology sector is the least likely to expect an impact, with 62 per cent of respondents saying rising energy costs will impact profitability – 10 per cent less than the average.

Technology firms and other professional services are definitely less dependent on energy consumption, especially considering the recent transition to remote working. But it’s possible some of these companies are underestimating the risk they face from energy. Not only do they depend on energy intensive data centres, but as Mathieu says,

They might think their energy consumption is just the electricity and heating systems for the offices. But they might not be thinking about the cost of the petrol for their salesperson or the higher cost of things like furniture or diverse office equipment from general inflation.”

Businesses can’t simply pass on these costs to their customers. Smith says,

Costs are going up for consumers as well. In the UK, the average energy bill could be £5000 next year. That’s crazy. And they can’t just pass the costs on because everyone’s budgets are tightening. That means less at the top line and increased costs. You’re getting hammered onprofitability in multiple ways.”

The reaction

Such drastic increases in costs present a serious threat to some businesses. In many cases, survival now depends on reducing costs and minimising the damage to the bottom line. In response, 77 per cent of firms are making changes to their business, with a quarter of all businesses saying those changes are radical.

How significant are the changes you are making (or have made) to your business in reaction to the energy price increase?

Smith says, “If one of your largest costs doubles, you’re absolutely going to be looking to innovate around that, either to reduce your reliance on it or remove it altogether. You’re just not going to rely upon that cost potentially going down in the future and losing money in the short to medium term. It’s a severe shock to your business and something needs to change.”

These pressures have jolted companies into action, with the automotive and pharmaceutical industries making the most radical changes. And while radical innovation might traditionally have been directed towards creating new products, it’s likely these changes are across their entire product lines.

This brings us to the all-important silver lining: sustainability. The energy crisis and the rise in fossil fuel prices is a natural catalyst for the transition towards greener energy. There’s already a drive to reduce carbon footprints and many businesses have declared intentions to reduce their carbon footprint. But progress has been slow. Businesses were previously working with more generous timelines, such as becoming carbon neutral by 2030. Now, the increase in costs has made change a necessity.

Smith explains,

The truth is that companies weren’t previously motivated to change. Reducing your carbon footprint is a huge upfront investment, which was often not commercially viable. I read about a project that involved retrofitting electric motors to old diesel- run trains. That was originally driven by decarbonisation, but if the cost of diesel has gone up substantially, electrifying vehicles can provide an overall cost saving. So now, it’s not purely altruistic goals of reducing your carbon footprint but reducing costs.”

Damage control

Naturally, most of the ways companies are adapting have a sustainable element. The most popular tactic by some margin – and being deployed by 44 per cent of businesses – is looking for energy efficiency savings, which can be achieved in a wide variety of ways. Mathieu says, “People’s minds might leap to making sure lights are off. But that’s very small compared to truly reducing energy consumption. Imagine if you can significantly cut the amount of energy needed to heat a furnace of a steel plant. That can deliver real impact.”

In which of the following ways are you looking to adapt to reduce these costs?

However, in order to improve their energy use, businesses must first analyse and understand their energy consumption. One option is to look for alternative energy sources, which is the second most popular tactic at 33 per cent, but it can be a simple matter of changing energy supplier.

Mathieu says, “The idea is to get the most energy for the best price. And that’s all about looking at the details. There are potentially big savings to be made through changing Tariff schemes, reviewing tax, implementing efficiencies plans or even planning energy use at times of year where there is less strain on the national network.”

Beyond looking directly at energy costs, businesses are doing as much as possible to reduce the impact. Johnson says, “It’s definitely made companies reassess and evaluate every possible option. Can we completely eliminate our exposure to fossil fuels across the whole lifecycle of a product?”

This sentiment has encouraged 30 per cent of businesses to look into alternative materials – such as those not derived from fossil fuels. However, another option is to look at supply chains, whether that’s assessing where you source materials or how you transport it. On par with alternative materials, 30 per cent of businesses are trying to source materials more locally, and 30 per cent are looking at their logistics.

To some extent, the last few years and the supply chain disruption from Covid-19 and the Suez crisis had already encouraged the localisation of supplies. But the increase in the cost of importing goods has made locally sourced goods more affordable. Mathieu says,

20 years ago, a factory for semiconductors located 50 miles outside Paris was about to close. Everybody was ordering from China. But it stayed open and now the plant seems more profitable than ever, with lots of local orders.”

Ultimately though, businesses would be wise to look at more radical changes. While smaller changes have limited impact, a big upfront investment will both bring costs down and provide long term resilience against the next spike in energy costs. Johnson says,

When I started driving, gas cost less thana dollar a gallon. Now, we’re paying almost five. It’s a problem that is likely to keep recurring.”

Support and learn

Reducing costs is a big undertaking and it’s clear that businesses need support. There would be value in introducing the infrastructure for businesses to share their successes, especially across sectors when businesses are not in competition. Smith provides an example,

Fertiliser manufacturers use a lot of natural gas, but are now finding alternatives. That could be applicable technology for the cement industry, which uses lots of gas as well.”

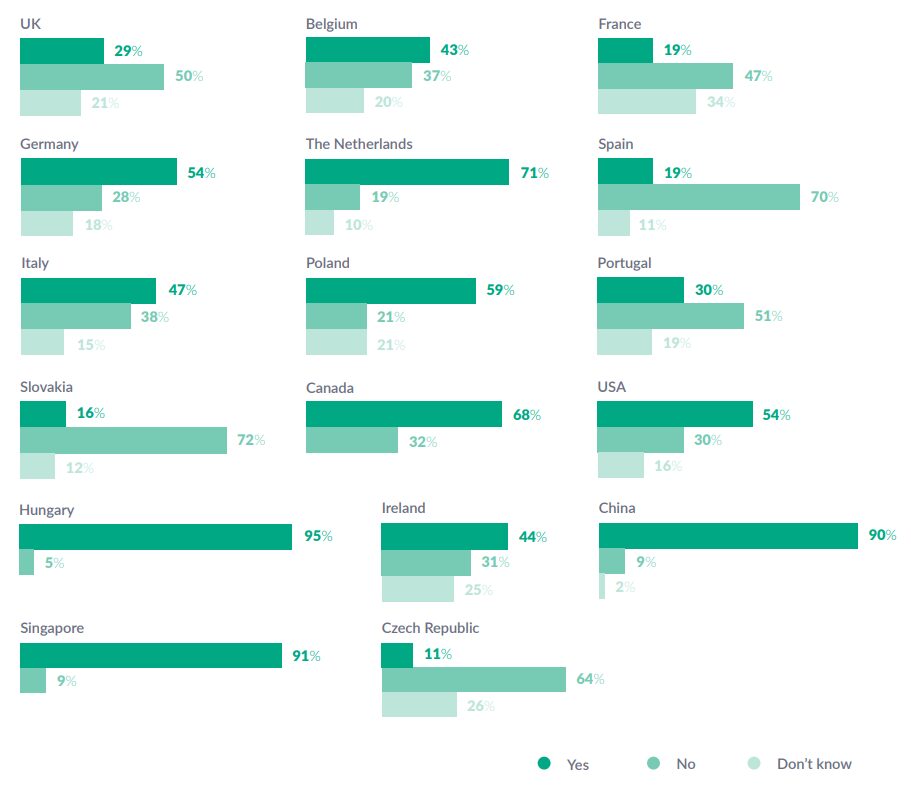

However, the most value will come from governmental support. Governments have a responsibility to facilitate and incentivise the transition. When asked if they believe they have sufficient funding, the responses are varied; 52 per cent say they do while 34 per cent say they do not.

Being a question of Government, the findings do vary significantly from country to country. The UK, Spain, Czech Republic are the least likely to believe they have enough funding, while Hungary, Singapore, China and the Netherlands are most positive about funding.

Either way, governments need to step up and support companies to navigate the energy crisis. Although lots of incentives are linked to decarbonisation already, governments must think carefully about their funding landscape and ensure they have a range of support mechanisms to stimulate the energy transition. And similar to how sectors can learn from one another, so too can Government.

Grants are most commonly associated with funding sustainability. These are a very valuable funding mechanism, but the funding looks to solve a specific problem, is not available to everyone, and applications are onerous. Therefore, businesses cannot rely on them solely.

Tax credits are a guaranteed way to secure funding for green innovation. Our

2020 Barometer made the case for a supercharged rate for sustainable R&D activity. However, tax credits are also restricted to some extent. To be eligible, the activity has to resolve a technical issue, meaning a lot of straightforward but potentially expensive changes businesses make to reduce energy use are not eligible for R&D tax credits.

As a solution and to stimulate action, governments can expand funding to any and all projects that reduce a company’s carbon footprint. This would be a much broader criteria than the tax credit and include changes outside of technical R&D – simple but valuable actions like localising manufacturing.

This is the sort of expansion some regions are introducing. Mathieu says,

In France, we have various specific energy incentives such as Grants to support new investments saving energy and generating lower CO2 emissions. These ones are quite massive and are deployed either at national and regional levels. It’s a matter of finding new ways to make companies put the money down. Government can’t make those changes for them. They can only give the companies the ability to do it.”

Section conclusion

Without any doubt, the energy crisis is threatening the survival of countless companies. Now, in attempts to weather the storm, companies are deploying a range of cost-cutting strategies, with sustainability being the core beneficiary.

But the huge upfront costs involved in making the necessary changes means governments would do well to expand funding and use the biggest range of incentives possible, with a combination of subsidies, grants, credits and other initiatives, such as the whitepapers in France.