Table of contents

Executive Summary

Construction and civil engineering is not only a bellwether for the economy, the industry underpins productivity more widely, as well as society’s quality of life.

Investment in construction is economically productive. The International Monetary Fund (IMF) estimates that a 1% increase in spending on infrastructure produces a 1.4% increase in GDP within four years.

However, productivity is a vexed issue – not just for UK Plc, but for the construction industry in particular. For more than a decade, construction productivity has been flat compared with other sectors: the service sector managed more than 30% growth in the 10 years to 2017, while manufacturing ratcheted up productivity levels beyond 50%.1

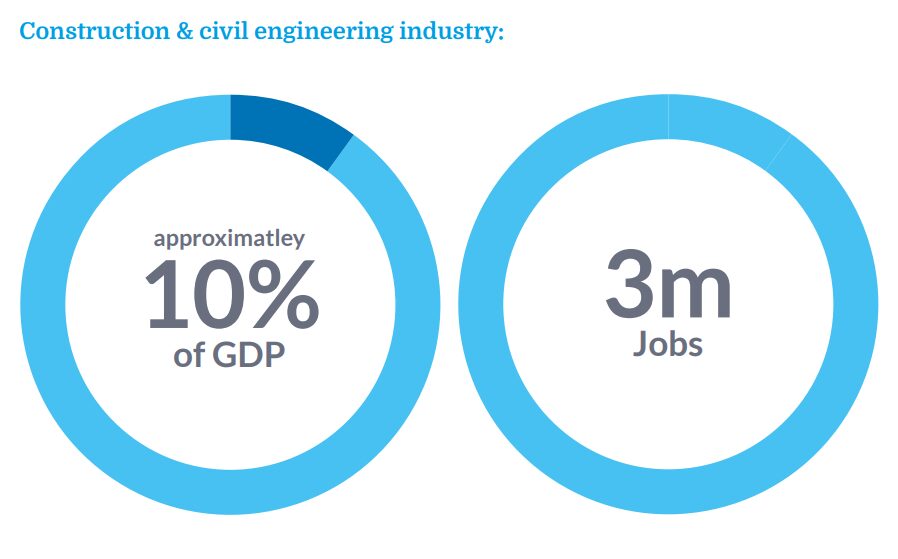

Given the importance of the construction and civil engineering industry to the national economy – about 10% of GDP and a similar share of employment, involving 3m jobs – the policymakers, at least, have been highly productive – creating: commissions of enquiry, strategies, taskforces, joint industry bodies, innovation initiatives, and new deals.

The latest, in 2018, built on the ground previously developed by Latham (1994), Egan (1998), Woolstenholme (2009) and Farmer (2016).

Innovation is at the heart of this Construction Sector Deal, struck by the government and Construction Leadership Council. It adopted a series of 2025 targets to spur innovation and productivity, so as to: halve both the time that projects take and the carbon footprint of the built environment, and slash a third off new-build costs and the whole-life cost of assets.

Research and development is central to these aims. The government is investing £170m – plus £250m from businesses – to create new processes and techniques as part of its transforming construction challenge.

The shared vision of government and industry leaders is to harness technology and the lean lessons from manufacturing to drive innovation, generate efficiencies throughout the supply chain, and streamline construction processes.

Innovation is happening and major changes are underway – as shown by the trends in robotics, digitalisation, smart materials and sustainability we review here. Impressive though these developments are, it is not yet clear that the pace and breadth of innovation will measure up to the scale of the challenges.2

These are colossal – not just stubbornly low productivity, but also an ageing workforce, growing skills shortages (that Brexit and tighter immigration controls will exacerbate), and the hardened commitment to net zero carbon by 2050. Yet, these pressures – alloyed with accelerating technological change – may finally force the far-reaching innovation necessary to recast a more efficient, productive and sustainable civil engineering and construction industry.

Robotics

The construction workforce’s new right hand?

Construction and civil engineering is one of the least automated industries. Rising labour costs and skills shortages are limiting the capacity of companies to take on and compete for projects. Yet contractors remain heavily reliant on manual labour.

Like other industries striving to produce more with less, the government and industry leaders have looked to car manufacturing for a solution. Carmakers pioneered the use of robots and lean thinking to streamline production, improve quality control and reduce costs.

Offsite manufacturing offers many significant advantages for construction. In a controlled environment, companies can more easily manage delivery of materials, precisely control the quality of building elements, and deliver them to site for rapid assembly to tighter tolerances.

The government has put its weight behind ‘modern methods of construction’ (MMC) to boost the industry’s capacity and close the perennial gap between housing output and the more than 300,000 new homes needed annually. That would require an additional 195,000 workers by 2025, but MMC could reduce this to around 158,000.3

Robotics can make these pre-manufacturing processes more efficient, while installation of standardised units should also lend itself to greater automation and the use of robots on site.

There have been several false dawns for the off-site revolution in more than two decades since Egan. However, the rise of the private build-for-rent market, and its faster lead times, could drive a more sustainable demand for off- site methods.

Insurer L&G entered the market in 2016 with Europe’s biggest off-site factory to supply homes for its private- rented development pipeline. Berkeley Homes, Swan Housing and others have also invested heavily. A pioneer of offsite construction, Laing O’Rourke launched its residential business in 2017 to disrupt the market on the back of its advanced manufacturing facility.4 In January 2019 the Weston Group opened a £12m centre in Braintree for storing, manufacturing and assembling home components.5 Chief executive Bob Weston predicted: “Within the next 10 years, technology will allow for new homes to be fully manufactured off-site by robots and computer-assisted engineering tools; with factory-made components then built on-site using machines like a highly advanced Lego-system.’

Factory production of modular homes and buildings could also make better use of material resources and reduce waste. The most resource-efficient method is 3D printing, or additive manufacturing. Even the entire structure of a house or bridge can be laid down in this way, using concrete, metal or other materials.

A park in Madrid has a 12m-long footbridge printed with micro-refined concrete.6 Perhaps one of several contenders to be the world’s first 3D-printed concrete bridge, it incorporates complex, nature-inspired forms rather than the simple geometries of traditional structures. Another 3D-printed bridge opened to cyclists in the Netherlands in October 2017.7 The designers of the 8m-long, reinforced, pre-stressed concrete structure hailed its sparing use of concrete compared with conventional mould-filled methods. Steel can also be 3D-printed. Last year, another Dutch robotics company, MX3D, produced a 6m structure from layers of molten steel. It was installed across a canal in Amsterdam.8

What’s promised to be the first 3D-printed concrete house is due to be completed in a technology and innovation park in the United Arab Emirates towards the end of 2019.9 Dubai has sets its sights on becoming the world’s 3D printing hub by 2030. “The technology will restructure economies and labour markets, and redefine productivity,” it predicts. By 2025, municipal regulations will require at least 25% of every new building to be 3D-printed – starting from 2% in 2019.10

A French start-up pioneering large-scale 3D printing for construction has begun rolling out a worldwide network of concrete printers. Following a pilot plant in Paris, XtreeE sited its second production unit in Dubai in summer 2019. It aims to have 50 worldwide by 2025.11 Backed by Vinci Construction and Shibumi International, XtreeE now promises a ‘printing as a service’ digital platform from 2020, connecting clients and designers to its printers.12

But can robots make the leap from factory floor to the more challenging terrain of the typical construction site? An industry with an ageing workforce – 20% may be nearing retirement by 202113 – and severe difficulties attracting and retaining young recruits, will increasingly need them.

The British ‘Motor Mason’ bricklaying machine developed in the 1960s didn’t catch on.14 SAM (Semi-Automated Mason) is a more advanced version, that also does the heavy lifting and places the bricks and mortar. A skilled tradesperson is still needed to smooth the finish, but output is multiplied six-fold to 3,000 bricks a day. Developed by Construction Robotics15 of New York, SAM has a conveyor, mortar pump and robotic arm, and costs around $500,000.16 In early 2019, several UK construction companies were reported to be interested in hiring the robo-brickie.17

Meanwhile, in Australia the Hadrian X robot was completing its first outdoor test build. FBR’s truck- mounted unit worked through the West Australian summer, high winds and at night, laying blocks for a three- bedroom home.18

Announcing its financial results this summer, major contractor John Sisk & Son revealed its decision to invest in small-scale block-laying robots and in off-site manufacturing to push up productivity and support its fast-growing build-to-rent business.19

Another innovation takes a bionic step on the way to robo- operatives by making manual labour more ergonomic. Eksovest is a high-tech exoskeleton harness developed by Ekso Bionics of the USA. It supports a worker’s arms during heavy lifting and lightens the load of power tools. Willmott Dixon began trialling the £5,650 vest on a Cardiff school building site in 2018.20

Trenchless techniques already allow more utility works to be delivered without digging. Maintenance and repairs of underground pipes would be even less disruptive with micro-robots. Four British universities are using a £26m government grant to develop 1cm-long devices with sensors to navigate and inspect pipe networks and mend the cracks they find.21 Other robots will be designed for hazardous applications in offshore windfarms and decommissioning nuclear power plants.

Back above ground, Japanese contractor Shimizu Corporation is preparing to put its robots to work on high- rise building projects, conveying materials, welding steel columns and installing ceiling boards.22

In the short to medium term, robotics may take over tasks rather than jobs. This should enable staff to deliver more work, safely and to higher standards, as they become human overseers for a wider range of automated activities.

In the longer term, construction could be almost totally automated, according to industry giant Balfour Beatty. Its vision of the industry in 2050 is for largely human-free sites where: teams of robots ‘build complex structures using dynamic new materials. Elements of the build will self-assemble. Drones flying overhead will scan the site constantly, inspecting the work and using the data collected to predict and solve problems before they arise, sending instructions to robotic cranes and diggers and automated builders with no need for human involvement.’23

Recent advances in robotics design and software are generating investment by the construction industry in automation – on and off-site – and we see that trend accelerating in an increasingly tight labour market as contractors are forced to produce more with less. Even if robots make up to 10% of the workforce, the boost to productivity would be significant. Furthermore, advances in artificial intelligence and machine learning can strengthen the business case for robots in construction and civil engineering.

Digitalisation

Modelling a smarter future

Balfour Beatty believes that the rise of digitisation and robotics in construction will bring about a huge increase in productivity.

However, thus far, construction and civil engineering have been slower on the uptake of digital innovation than most other industries. This may be changing thanks to Building Information Modelling (BIM).

BIM has the potential to drive technological innovations across the sector that feed off, or into, these digital models. Skanska, for example, is focusing on connecting its CAD systems to robotics, so robots understand what is required and have the autonomy to execute tasks without human input.24

The government has thrown its weight behind BIM, not least by using its purchasing clout.

Digital Built Britain – the government-led programme to create a digital economy for infrastructure, buildings and services – aims to transform how the construction industry operates by digitising the entire life cycle of the UK’s built assets.25

BIM is central because it provides the most detailed analytical view of a built asset during design and construction, and can also inform maintenance. The data it generates helps the project team and supply chain make more informed decisions about the whole-life cost of an asset, improve productivity and reduce waste.

The UK’s 2011 Construction Strategy defined four levels of BIM to help clients and suppliers understand how the technology should be used on projects and set standards for procurement. All government departments currently sponsor projects at Level 2.

Development is under way for Level 3 – expected in the mid-2020s – when projects will be fully collaborative, with BIM ‘objects’ rather than files, creating a single, shared project view with all data integrated and accessible to all.

The Internet of Things (IoT) is becoming a reality after years of hype. One of the most fertile grounds for deploying IoT is the built environment. More businesses are exploiting the technology, not least for smart homes and smart cities. The IoT and advanced data analytics will spawn new opportunities for BIM as well as the wider digitalisation of construction and civil engineering.

Other technologies link to and extend BIM. Virtual and augmented reality (VR & AR) can be used to model, plan and visualise progress on-site.

AR technology can overlay 3D digital content from a BIM model seamlessly on a construction site to help architects, construction workers and clients orient themselves and understand drawings. A walkthrough of the entire project can also help identify potential hazards and catch any design flaws before ground is broken. During construction, workers can use an AR unit to take measurements and highlight variances from specifications.

Clients can view 3D models, 360-degree videos and pictures, and 4D sequences, and share them with stakeholders using multi-screen immersive methods with no need to wear headsets. As users are placed inside the virtual environment, they don’t need to be on site. Teams can collaborate in real time from remote locations and share lessons and advice to improve designs and construction processes.

As with BIM, the government is backing VR/AR. Innovate UK gave a consortium backed by Laing O’Rourke and Microsoft £1m in funding to develop their use in collaborative design, job guidance, progress monitoring, safety guidance and asset management. The aim is to reduce project costs and waste by 25%, and increase productivity by 30%.26

Specialists in the field believe that within 10 years, enhanced 3D sensing capabilities will generate millimetre-

-precise maps of buildings, and enable users to access information on every element and view the project – forward and back – over its life cycle.27

Drones provide a different, bird’s eye view of a construction site, but also increasingly accurate and detailed data to inform project management. The sector is leading in commercial deployment. In the US, drone usage doubled in 2018. In the UK and Ireland, a third of companies deployed drones in 2017, rising to more than half last year.28 The top three reasons were improved data, saving time and risk reduction.

With their accompanying software, drones are capable not only of detailed mapping but also volumetric analysis and thermal heat imaging. This data can be easily gleaned even in hazardous and hard-to-access areas. Potential future developments range from micro-drones that, guided by BIM data, carry out inspection fly-throughs autonomously, reporting back progress and any anomalies, to more powerful unmanned aerial vehicles (UAVs) that lift and even place components on high-level structures.

With the take-off of the Internet of Things, new applications and other digital apps are arriving in waves.

Some streamline processes and provide instant updates on demand. Site managers can track critical deliveries in real time, and receive instant electronic proof of delivery. Tarmac claims to be the first to use intelligent mobile monitoring technology to manage the consistency of ready-mix concrete in transit, and provide this mix and slump data on demand.29

Others will improve safety in what is still one of the most hazardous industries. It’s likely that wearable tech will be as common on-site as in the gym now. The new Personal Protective Equipment (PPE) might be linked to virtual safety barriers on sites, or monitor a worker’s heart rate, exposure to dust or hand/arm-vibration, vigilance, or stress.30

Design hazards are said to be responsible for up to half of accidents on construction sites. Researchers at Glasgow Caledonian University believe that their app – based on a knowledge database of design options – can help architects and engineers identify them.31

In July 2019 a free open-source app was launched to accelerate the design process for offsite-manufactured housing systems. Prism, which is backed by Transport for London, developers and investors (Legal & General, Greystar and L&Q), links to the London Design Code.32

The race to launch driverless cars is likely to have ramifications for work sites too. Highways contractor Amey is working with robotics specialist RACE on an autonomous vehicle that would check the condition of road surfaces.33

Autonomous dump trucks are being trialled for the first time on a UK road scheme. Earthworks contractor CA Blackwell is using the vehicles on the A14 Cambridge- to-Huntingdon trunk road contract. Highways England provided £150,000 from its innovation fund for the trial.34

Given the potential for digitalisation to transform construction and civil engineering, it’s little wonder that the major contractors are appointing digital directors and technology officers in a bid to future-proof their businesses. Last year Costain revealed that one third of its 1,300 staff were now working in technology or consultancy roles.35

From contractors to service companies, firms in the industry will need to recruit and train many more graduates and apprentices with a new skillset. As the industry changes it should become more attractive to a digital-savvy generation turned off by the thought of mud- caked boots and draughty Portacabins. But the onus is on construction and engineering to change its image, and fast – every other industry is competing for that digital talent.

Materials

Testing times require new resources

Most of the built environment around us has been created from a relatively small palette of traditional materials: brick, concrete, steel, timber and glass, and in our roads, asphalt and bitumen, or again concrete (both containing stone aggregates).

This can be cited as further, material evidence of the construction and civil engineering sector’s entrenched conservatism and design codes; notwithstanding improvements to traditional materials – such as polymers and other additives that make road surfacings thinner, more durable and quieter, and lighter or faster-setting concrete.

In a world that’s using up resources at an unsustainable rate, and belatedly facing up to the daunting challenge of decarbonising society, a wider array of re-engineered and break-through materials is needed.

Technological leaps – sometimes in other sectors – have resulted in smarter construction materials and radical change. A sector that embraces the waves of innovation unleashed by BIM and digitalisation is more open to new and emerging products – provided they are backed by whole-life and sustainability data that also convinces clients and regulators of their benefits.

A lot of work has been done incorporating waste products into building materials such as asphalt and concrete – to close the resource loop, at least partially, and to replace virgin and/or more expensive elements such as stone aggregates. Crushed glass, shredded rubber tyres, oyster shells and pulverised fuel ash from incinerators are examples.

Innovations can also take familiar materials and combine them in new ways. Cross-laminated timber (CLT), for example, achieves greater multi-directional strength than natural wood by sandwiching layers at right angles to each other. More UK developments are availing of CLT’s advantages – design flexibility (extending to multi-storey ‘plyscrapers’), lightness and thermal insulation properties. Its biggest boost may come from its suitability to various prefabrication building systems.

Concrete is one of the most versatile and universal building materials. Just as lightweight and self-compacting concrete mixes have been designed for particular applications, if sparingly used, new formulas are being and will be developed. Whether the benefits are financial, performance-related or environmental, they need to be significant to drive adoption. But the commitment to net zero carbon emissions is bound to spur interest in new (and sometimes not-so-new) alternatives. Replacing Portland cement would be a huge leap given the environmental impact of its extraction and processing. Instead, geopolymer concrete – sometimes called ‘green’ concrete – uses fly-ash (a substance that, like the volcanic ash used to long-lasting effect in Roman concrete,36 can lend strength and durability). Lendlease has won green plaudits, not least for specifying geopolymer concrete in its Trafalgar Place development in London, along with other more sustainable alternatives such as CLT.37

Laing O’Rourke is one of the contractors that has pioneered use of zero-cement concrete. One version, Cemfree, is said to save 80% of embedded carbon compared with traditional mixes.38

Self-healing concrete represents another order of innovation many considered fantastical. Backed by grant aid from the Engineering and Physical Sciences Research Council, the Resilient Materials 4 Life (RM4L) programme is exploring this and other adaptable and sustainable construction materials.39

Success would have significant financial as well as environmental implications. Every year £1bn is allocated for maintaining and repairing damage to the UK’s infrastructure. Costain has also backed the RM4L research, and in 2015 constructed five sections of concrete retaining wall on the A465 Heads of the Valley upgrade in Wales to test several self-healing systems.

Self-healing bio-concrete is made with microcapsules in the mix that contain bacteria and an organic nutrient (calcium lactate). When cracks occur and water penetrates, it activates the bacteria, which feed and secrete calcite (limestone), filling the cracks. Microbiologists at Delft University developed and patented a self-healing concrete, now marketed as Basilisk. Used as an additive for new- build, a spray or a repair mortar, it cures cracks up to 0.8mm; further development is ongoing.40

The ultimate circular solution would be to trap CO2 and turn it into a building material. Start-up Cambridge Carbon Capture has received Innovate UK grants to begin scaling CO2LOC technology that replaces concrete fillers, blocks, tiles and plasterboard.41

Technologies emerging, and merging, as part of Industry

4.0 – the so-called fourth industrial revolution – could accelerate development of a raft of new and composite materials that promise to be lighter, stronger and more sustainable.

These may exploit nanotech – tiny particles that turn the traditional steel or concrete into “smart” materials able to measure their stress state, deformation, risk of failure or incorporate other useful characteristics.

Harnessing artificial intelligence and 3D printing as well could spawn a new generation of superior materials based on natural evolution. Construction and civil engineering may have to adapt discoveries made in other sectors. AI helped Airbus use ‘generative design’ software to test millions of metal alloy configurations inspired by slime mould and mammal bones. Its 3D-printed ‘bionic’ partition has optimal strength and lightness for future aircraft.

Predating Industry 4.0, graphene – the wonder material that won the 2010 Nobel Prize in physics for researchers at Manchester University – has countless applications across industries.42 A single layer of carbon atoms could form a perfect barrier in buildings and infrastructure: from a rustproof coating for steel to membranes that filter water pollution or absorb carbon dioxide. An early application is in paint.

Highways England earlier this year linked up with the Graphene Engineering Innovation Centre to explore how the disruptive technology could extend asset life and raise the network’s performance to “an industry-changing level”.43

It followed the award of £23m government money to research projects aiming to future-proof UK roads. These Live Labs projects demonstrate a range of new technologies in local authority areas. Trials include ‘Power Road’ technology, piloted in France, using geothermal energy to de-ice carks and bus stations; embedded sensors to target highway maintenance more efficiently; and extending use of plastic as a surfacing material.44

The research effort is ramping up. Much of the government-backed work is focusing on smarter design and use of materials within prefabrication systems. Said to be the government’s largest ever initiative in the sector, the Construction Innovation Hub was born out of the UK government’s Construction Sector Deal, and launched in November 2018 (with £72m from UK Research and Innovation’s Industrial Strategy Challenge). It has now announced the Platform Design Programme, an open call to firms to help develop a new ‘kit of parts’ to transform the sector.45

The Hub is following the ‘Design for Manufacture and Assembly’ (DfMA) approach seen by government as key to modernising construction. A parallel initiative in Scotland – Advanced Manufacturing for Construction of Homes – aims to develop digital design tools, advance manufacturing, and improve near-to-market offsite systems.46

Some contractors and supply chain partners are impatient for progress. Last year, Colmore Tang Construction teamed up with Virgin StartUp to launch their own construction technology accelerator programme.47 Called ConstruTech, this £10m fund is for innovative start-ups anywhere in the world with new solutions in the areas of people, data and smart materials that can improve construction’s productivity, sustainability and skills. “Other industries are much better at seeing the potential in technology and grasping opportunities to boost productivity and commercial gain,” Group CEO Andy Robinson declared. “Construction is falling behind and it’s having a negative impact on the sector, growing the divide between the traditional, ageing workforce and the young, technologically-advanced workforce that is choosing other industries over ours.”

Faster development of smart materials can help bridge that chasm and the sector’s productivity gap.

Sustainability

Net zero win game

The UK is the first G7 nation to set a legally binding target to achieve net zero carbon emissions by 2050. Amid the escalating climate crisis, outgoing PM Theresa May upped the ante from the previous 80% reduction target.

It is not just the construction sector that needs to show rock-solid commitment to that goal. After almost a decade’s preparation, the industry saw the visionary Zero Carbon Homes policy cancelled in July 2015, a few months before implementation. Then the government pulled the plug on the Green Deal to get homes retrofit for an energy-efficient future, after the sluggish programme had finally taken off.

If the goal is to be met, the industry has little more than 10 years to make all new buildings net zero, according to the Committee on Climate Change. The scale of the challenge is massive: the built environment produces 40% of carbon emissions and uses 60% of materials,48 while some 60% of all waste in the UK comes from the construction industry.49

Trends in robotics and pre-manufacturing, digitalisation and alternative materials are reinforcing the sector’s push towards sustainability. There are many exciting developments in hand or on the horizon.

Wholesale changes to energy-generating infrastructure are required – away from boilers to heat pumps, hydrogen technologies, and district heating schemes, along with more efficient lighting. Improving the energy efficiency of existing buildings and housing stock will call for an even greener new deal.

Combined heat and energy plants – as in Lendlease’s estate regeneration project at Elephant & Castle in London – and on-site renewables such as solar power, will become common.

The aim must be to construct energy-positive buildings that give back more than they consume over their lifetime. Skanska, for instance, says its European development business will be the first worldwide to cover office buildings with semi-transparent perovskite solar cells on a commercial scale. It began a trial in 2018 with Polish tech firm Saule Technologies, and aims to revolutionise the industry’s approach to energy self-sufficient buildings.50

Funding from the UK Research and Innovation challenge is supporting a series of projects investigating how buildings could be powered through active generation and storage. The fund also backed HIPER Pile, a project led by piling specialist Keltbray to develop new piling methods that integrate energy and rainwater re-use when laying foundations.51

There is huge scope for material producers to harness technology to improve energy efficiency, switch to lower- carbon fuels and renewable sources. Investment in battery storage and other smart solutions will be required. But there are financial as well as carbon savings to be made. Aggregate Industries says it was the first in the UK to automatically optimise its electricity demand in real-time via a dynamic demand management platform that uses AI to cut bills and energy intensity by 10%.52

Decarbonising energy use on construction sites, where diesel power is the dominant power source, is an even more daunting prospect. Major contractors have trialled photovoltaic lighting towers and hybrid generators but the technology is still modest and small-scale. Network Rail and Colas have shown the way to the ‘site of the future’. They used solar-powered lighting and generation to achieve 97% diesel-free operation across the 21-acre rail renewal site at Llanwern in South Wales.53

As for mobile plant, electric excavators have started to appear, as plant hirers and principal contractors such as Laing O’Rourke and Murphy show interest. Corporate commitment, government deadlines or both will be needed if plant suppliers are to catch up with e-carmakers.

On the road, contractors are still at the stage of smallscale trials. FM Conway began trialling two electric vans in November 2018, ahead of London’s Ultra Low Emission Zone (ULEZ) launch in April 2019. Hybrid electric vans proved they were a viable alternative for construction firms Clancy Plant, Interserve, and Mears Group in a recent 12-month Ford Motor Company trial.54

As ULEZs spread, contractors working in those cities will be in the vanguard of the converted, ahead of the 2040 deadline for new cars and vans. Though Tesla has launched its all-electric truck, the Road to Zero for heavy haulage will be longer.

Progress is being made in tackling construction’s huge waste stream. Some housebuilders, like Barratt Developments, and highway contractors such as Eurovia/ Ringway are diverting as much as 97% of waste from landfill.

The highways industry can reuse more road planings and other materials arising from maintenance in their works, including energy-saving ‘cold’ and ‘warm’ alternatives to hot rolled asphalt. Wastes from other sources are also being recycled into roads and footways.

Two of the most problematic waste streams are plastics and tyres.55 Tarmac has launched the first commercial asphalt product containing rubber from waste tyres. After years of one-off trials by many companies, it’s hoped the highway authorities will bend their rigidly prescriptive specifications to adopt a product proven in other countries. As more local authorities declare a climate crisis, they can pave the way to a lower-carbon network.

Concrete is the most widely used material on earth, apart from water. (Water also needs to rise up the sustainability agenda as concerns grow about regional, as well as local supply stress.)

Several studies indicate concrete is responsible for at least 5% of humanity’s carbon footprint. Yet the cement and concrete sector can feasibly cut emissions by 80% by 2050, according to Swiss research.56 The cost would be relatively low with some financial savings to be made, but it will require concerted effort across the entire supply chain. To get to net zero, producers would require carbon capture and storage. We expect producers to continue investing in carbon reduction and wider production of alternatives, such as geopolymer concrete.

The most fundamental mindset change will be designing new buildings to be net-zero carbon. There are encouraging signs that the sector is up for the challenge. In a UK survey, almost two-thirds of companies were confident they could achieve this before 2050.57

BREEAM, the international benchmark for assessing the sustainability of buildings and infrastructure, is recognising and promoting more environmentally responsible design. BIM can also support this trend further. Additional data on traceability, responsible sourcing and carbon footprinting can be embedded in BIM objects (product specifications) to provide a more complete understanding and help to deliver a sustainable built environment. As can initiatives such as the Supply Chain Sustainability School, collaboration between major UK contractors to provide free training to help suppliers become more sustainable.

Willmott Dixon reports that it has been carbon-neutral for six years, having reduced the carbon intensity of its operations (relative to turnover) by 57% compared since 2010. Skanska has set a target to be carbon neutral throughout its supply chain by 2045.

Many other contractors and suppliers are taking, and will continue to take, valuable steps and strides in sustainability. The national commitment to net zero means that the whole sector – some 280,000 companies widely varying in size and specialisms – must follow suit to make truly sustainable practice business as usual.

Topping out

Could the next five years see more profound change in construction and civil engineering than the last 50? Many in the industry believe, or hope, so.

Robotics and digitalisation can catapult efficiency and bridge yawning workforce and skills gaps, by increasing output per employee and attracting a new generation of digital natives. But the whole industry must buy in to BIM – from contractors who insist on working from 2D drawings to clients who don’t yet understand or value the data.

As the looming climate crisis concentrates minds, companies will have to make sustainability a core business goal. And intensifying research efforts must yield more low/no-carbon materials and smarter construction techniques.

These four trends – in robotics, digitalisation, materials and sustainability – among others, will help build that more efficient, productive and sustainable industry. But progress still hinges on government sustaining its enabling environment for innovation; wider collaboration not just within the industry, but trans-sector too; and on its huge supporting cast of subcontractors and suppliers replicating the vision and cultural shift of the leading tier-one contractors.

Innovation that can help drive the bottom line

The following are examples of client projects that Ayming’s Civil Engineering & Construction team has identified as qualifying for R&D incentives:

Construction

- Advances in engineering to develop new or unique materials and combinations of materials.

- Use of automation to lower costs and speed up construction times.

- Design & build of specialist machines or the modification of existing equipment.

- Creating, improving or adapting existing construction methods, materials and design for projects.

Transport & urban infrastructure

- Improved infrastructure design of transportation, water, or sewer and storm water networks.

- Water storage and pump station design.

- Bulk earthworks design, improving cut fill quantities, site drainage and material selection methods.

- Development of sustainable drainage solutions, e.g. green space design, retention and detention facilities or permeable paving solutions.

- Replacement of old pipe infrastructure using new methods e.g. Pipe Cracking, Cured In Place Pipe (CIPP), lining of existing pipes or improved horizontal drilling methods for pipe replacement.

Marine & Coastal

- Improved pile design and/or installation methodology required to support offshore structures.

- Unique harbour/break water design.

- Development or improvement of sub-sea installation methodologies to overcome site-specific challenges.

Geotechnical

- Advances in geotechnical investigation or treatment of ground contamination and land reclamation.

- Advances in structural groundworks, e.g. piling, retaining systems or tunnelling methods, constructing in difficult sites or ground conditions requiring adaptation to standard construction methods.

Environmental & sustainability

- Development of improved utility services for residential and commercial properties to reduce carbon emissions.

- Integration of renewable energy systems into standard building design.

- Development of low carbon impact materials for building construction.

Structural design

- Unique infrastructure design.

- Optimisation of structural design to reduce amount of materials.

- Software developments to optimise dynamic analysis.

Demolition & waste management

- Recycling of building rubble and waste to create new products with higher performance at a reduced cost.

- Optimisation of demolition process to enable the use of smaller machines to reduce the props required to support the structures.

- Extensive equipment modification to overcome issues related to project specifications or site environment.

- Design of renewable energy infrastructure for industrial and commercial end users.

Utility Services

- Improved biomass fuel handling and storage facility design & construction at processing plants and power stations.

- Improving overhead line design or construction (e.g. new pylon design, improved construction methods or new material incorporation).

Joana Palha

Manager, Innovation Incentives

Joana started her career as a Civil Engineering in Brazil where she worked in transport infrastructure civil works. She then moved to the UK in 2012 where she had the opportunity to work on the biggest construction project in Europe – Crossrail. She was also involved in the construction of the Doha Metro in Qatar. Joana has a Bachelor’s Degree in Civil Engineering and a Master’s in Structural Engineering. As a manager in Ayming’s Construction team, Joana works with clients across the Construction and Civil Engineering sector to deliver tax incentives to support their innovation.

Email: jpalha@ayming.com Telephone: 020 30 58 58 00

Max Pearson

Senior Manager, Innovation Incentives

Max has over 6 years of experience delivering R&D claims specifically for the Construction Industry. His PhD in Post Tensioned Concrete and his time as a design engineer has enabled him to successful develop a wealth of R&D claims for the sector from small architectural practices to top tier contractors. Max has a Beng Civil Engineering an MPhil Structural Engineering and a PhD in Structural Engineering.

Email: mpearson@ayming.com Telephone: 020 30 58 58 00

1https://www.macegroup.com/perspectives/171027-moving-to-industry-40

2https://www.ukri.org/innovation/industrial-strategy-challenge-fund/transforming-construction/

3https://www.citb.co.uk/about-citb/construction-industry-research-reports/search-our-construction-industry-research-reports/innovation-technology/the-impact-of-modern-methods-of-construction-on-the-skills-require- ments-for-housing/

6https://iaac.net/project/3d-printed-bridge/

7https://www.theguardian.com/technology/2017/oct/18/world-first-3d-printed-bridge-cyclists-netherlands 8https://www.dezeen.com/2018/04/17/mx3d-3d-printed-bridge-joris-laarman-arup-amsterdam-netherlands/ 9http://www.technicalreviewmiddleeast.com/it/printing/first-3d-printed-house-to-be-ready-in-sharjah

15https://www.construction-robotics.com/

16https://www.digitaltrends.com/cool-tech/sam-bricklaying-robot-6x-faster-than-you-can/ 17https://www.thesun.co.uk/news/3186505/bricklaying-robot-that-works-faster-and-harder-than-humans-could-put-thousands-of-brit-builders-out-of-work/

18https://www.fbr.com.au/view/asx-articles/20190212095133

19www.constructionenquirer.com/2019/06/06/robots-to-ramp-up-sisk-margins-in-productivity-push/ 20www.constructionenquirer.com/2018/10/03/willmott-dixon-trials-robo-builder-vests-on-school-site/ 21www.constructionenquirer.com/2018/12/31/mini-robots-plan-to-fix-underground-pipes/

22https://www.theconstructionindex.co.uk/news/view/japanese-robots-to-work-on-high-rise-buildings 23https://www.balfourbeatty.com/how-we-work/public-policy/

29http://innovation.tarmac.com/connect-assure/

30https://www.theconstructionindex.co.uk/news/view/press-blue-for-stressed

31https://www.theconstructionindex.co.uk/news/view/scottish-uni-develops-life-saving-construction-app 32https://www.prism-app.io/

33www.constructionenquirer.com/2017/04/12/amey-trials-driverless-cars-to-check-for-potholes/ 34https://www.highwaysmagazine.co.uk/Driverless-truck-trialled-on-A14-project-/4871 35www.constructionenquirer.com/2018/08/22/tech-savvy-workforce-key-to-costains-future/

36https://www.ayming.co.uk/insights/opinion/set-stone-future-roman-concrete/ 37https://www.lendlease.com/uk/-/media/llcom/investor-relations/media-releases/2016/20161201_lend-lease-hailed-most-sustainable-residential-developer.ashx

38https://dbgholdings.com/cemfree/ 39http://rm4l.com/about/

40http://www.basiliskconcrete.com/?lang=en

41https://www.theconstructionindex.co.uk/news/view/cambridge-lab-tests-prove-possiblity-of-zero-carbon-construction

42https://www.graphene.manchester.ac.uk/learn/applications/ 43https://www.theengineer.co.uk/highways-england-geic-graphene/ 44https://www.theconstructionindex.co.uk/news/view/green-light-for-highways-research-funding

45https://www.futurebuild.co.uk/industry-news/construction-innovation-hub-invites-firms-to-help-develop-newkit-of-parts-to-transform-sector

46https://www.theconstructionindex.co.uk/news/view/collaborative-project-seeks-to-develop-house-building-innovations

47https://www.virginstartup.org/constructech

48https://www.ukgbc.org/climate-change/

49https://www.edie.net/news/12/How-to-build-a-sustainability-culture-within-the-construction-industry/ 50https://www.skanska.pl/en-us/about-skanska/media/press-releases/215371/Skanska-launches-first-per-ovskite-solar-cell-application-in-office-buildings-together-with-Saule-Technologies

51https://www.ukri.org/news/construction-industry-to-be-transformed-through-digital-technology-thanks-to-18-million-ukri-funding/

52https://www.aggregate.com/news-and-resources/press-releases/aggregate-industries-and-open-energi-partner-to-deliver-uk-first-rollout-of%20ai-powered-flexibility-platform

53https://www.colasrail.co.uk/site-of-the-future/

54https://www.theconstructionindex.co.uk/news/view/trials-show-viability-of-hybrid-power-for-commercial-vehicles

55https://www.theconstructionindex.co.uk/news/view/when-the-rubber-hits-the-road