UK is an R&D superpower

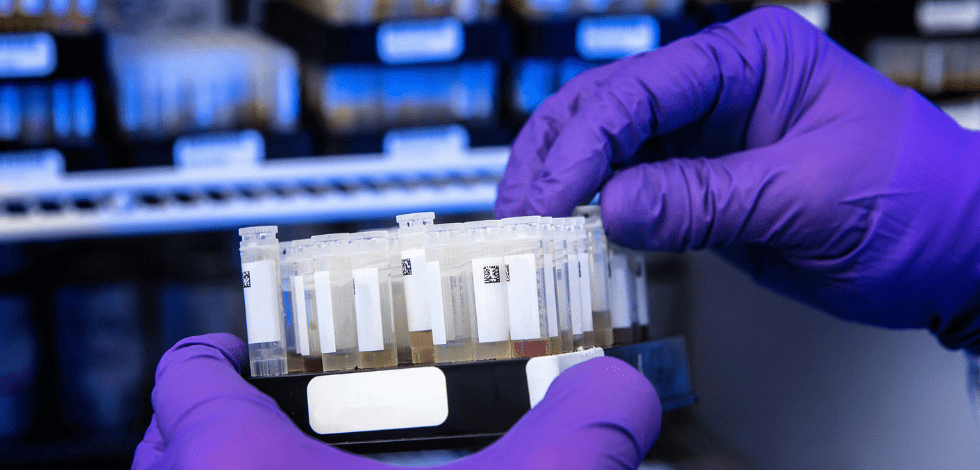

I have seen some fear-mongering in the R&D tax press of late. There is talk of unscrupulous providers and hidden costs. This does harm to the broader innovation landscape within the UK when we should be celebrating. The UK is an R&D superpower, as can be seen with our involvement in recent Covid vaccine developments. We consistently punch above our weight, and our Government’s R&D tax incentive is as generous as it is inclusive.

As evidenced by HMRC’s continued (and welcome) crackdown on fraudulent claims, there are improvements to be made. Still, ultimately the scheme is very generous and a key incentive for UK innovation.

To offer some advice to those unfamiliar with R&D tax incentives: as with any part of your business in which you engage with external suppliers, it is crucial to select the right advisor for you. Be rigorous in your selection process, and you’ll be rewarded with a long-term partner that adds real value to your business.

Britain is still on the Horizon

With Brexit, there was a big chance that UK businesses would lose access to funding programmes for pan-European research projects, such as the hugely successful Horizon 2020. It is fantastic that as part of Brexit negotiations the UK Government secured a place as an ‘associated country’ on Horizon 2020’s successor programme, Horizon Europe. This means that UK businesses can continue to join consortiums and apply for EU funding to further their research and development.

Collaboration is essential for many research-led, innovative businesses, and it’s equally important to have access to a vast pool of new thoughts and ideas. The UK must capitalise on its inclusion in the programme.

R&D is still on the Roadmap

The Department for Business, Energy & Industrial Strategy has this month updated its UK R&D Roadmap survey and summarised the responses. It is good news that the Government speaks of the entire innovation ecosystem – from funding and collaboration to education and commercialisation.

Whilst funding is essential, there are plenty of other levers across the economy that the Government can use to incentivise businesses. A move away from ‘Most Economically Advantageous Tender’ would be a great start. Research conducted by the CBI last year shows that for every £1 spent on UK construction £2.92 of value is created to the UK. The MEAT criteria, commonly used in public sector procurement, have become synonymous with cost reduction and fail to encourage innovation and the positives that come with it.

It appears that the UK Government will invest serious money in the UK innovation landscape, which is vital for it to succeed post-Brexit. There will undoubtedly be a budget squeeze coming up, especially after the necessary Covid-19 spend, and so the Government must honour its commitment to innovation.