It’s an exciting time for manufacturing and innovation is shaking up the game, with firms entitled to a vast amount of manufacturing R&D tax credits. In recent years, manufacturers have started to benefit from technologies that have been maturing for some time, such as big data, machine learning and 3D printing.

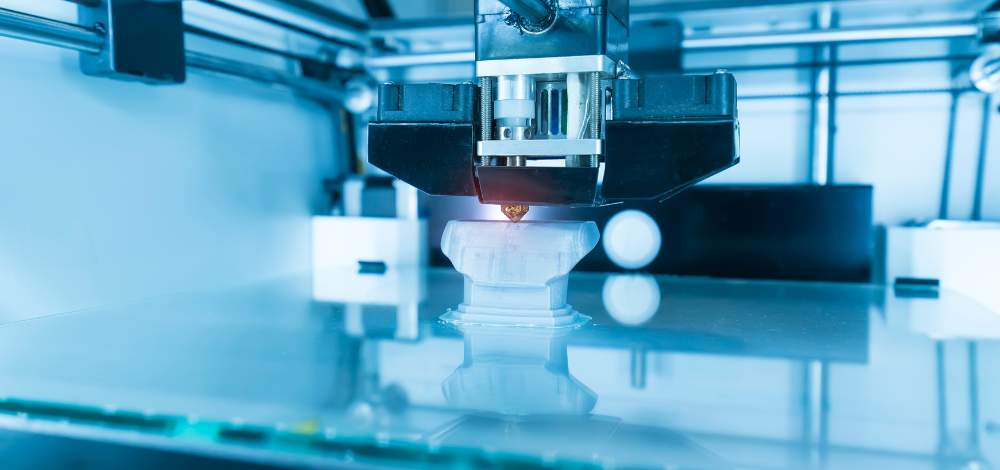

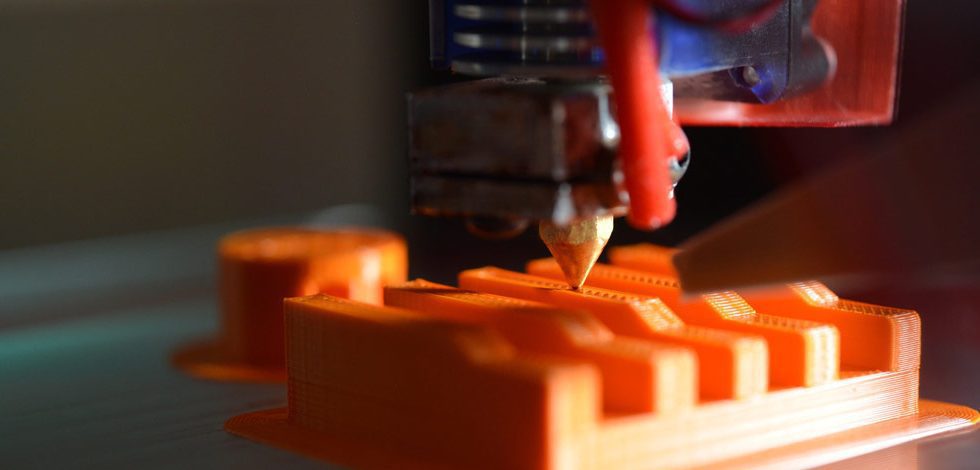

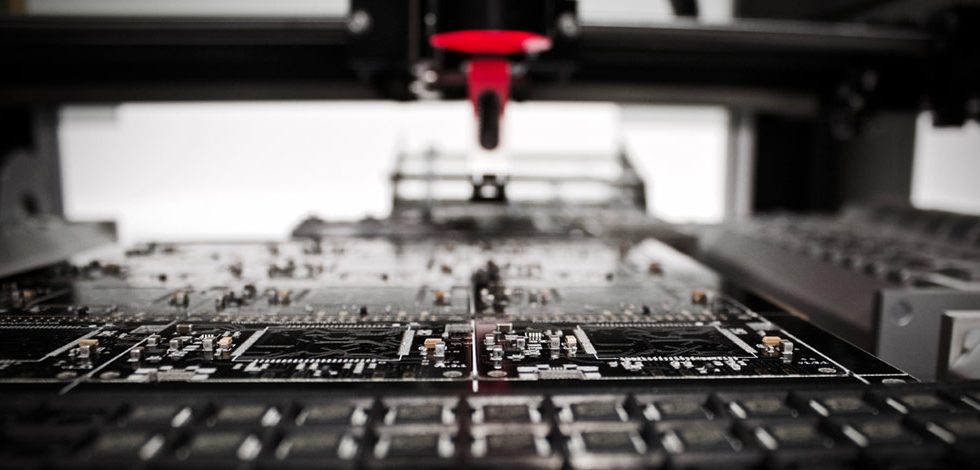

To kick this year off, Duncan Kelly explored the UK’s 3D printing in an article entitled “What’s next for additive manufacturing?”. The UK is a world leader in 3D printing and has played a vital role in advanced R&D for some 20 years, supporting with prototyping and testing. It now contributes over £500 million to the UK economy and has important knock-on benefits for high-tech industries. However, as Kelly argues, 3D printing needs continuous innovation to stay ahead of the game, leveraging in particular high-quality data to support increasingly challenging and sophisticated projects and ensuring they access all manufacturing R&D tax credits. This article was also published in TCT Magazine in July.

However, food and beverage has been a big focus for the team this year. In April, we published a case study on British Bakels, giving insight into an exciting project with a leading bakery ingredients manufacturer. Bakels use a range of different and innovative techniques to produce over 250 ingredients. Our team was brought in to manage the company’s R&D relief claims, increasing qualifying expenditure by £945,000 for their claim for 2019 while also building a robust methodology for the company to maximise claims going forward.

Building on food and beverage, the team published a whitepaper on the winery sector. Being an ancient industry, transformation and technological development are a daily challenge in wineries. The industry is constantly exploring new production techniques and experimenting with new products. However, resolving these technical challenges usually qualifies for manufacturing R&D tax credits, which provides an opportunity for the sub-sector. Many wineries are not making full use of the funding available.

The team also keeps a watchful eye on legislation and drafted two articles drawing attention to policy changes across the year. In June, Rhyl Jones wrote an article about the Plastic Tax, which aims to stimulate better recycling, while in September, Jones wrote another piece on new food labelling regulations.

This year also saw our team expand their horizons into webinars, which were recorded and are available for anyone to watch, anytime. On the food and beverage side, the team held a webinar on maximising manufacturing R&D tax credits in May. The hosts, Thomas Ferguson and Apostolos Zacharakis, discussed all things on food innovation, including the latest trends, how people apply, and what qualifies for R&D credits. The next webinar is already booked in for February 2023 and covers an entirely different arm of the sector, covering the latest innovation in manufacturing, R&D tax credits among engineering-based manufacturers, and how people can maximise funding.

Stay tuned for more content next year.

Notes to Editors

Ayming is a leading international Business Performance consultancy and has a global footprint. The Group is present in 15 countries: Belgium, Canada, Czech Republic, France, Germany, Ireland, Italy, Japan, Netherlands, Poland, Portugal, Spain, Slovakia, the UK and USA with a staff of approximately 1,300.

In the UK, Ayming helps businesses to improve their financial and operational performance through innovation, tax, and HR performance.

Press Enquiries

Annabel Rivero, Aspectus Group

+44 20 7242 8867

No Comments