This afternoon, Chancellor of the Exchequer, Jeremy Hunt, announced his Spring Budget 2023. Narrowly avoiding a recession, the UK economy is still in jeopardy, and the Chancellor has the unenviable task of trying to bring some semblance of stability to the country against the backdrop of the ongoing illegal war in Ukraine and the cost of living crisis.

Below is Ayming’s view on key points within the Statement and what they mean for the R&D tax landscape.

Support for R&D-intensive SMEs

- Increased rate of relief for loss-making R&D-intensive SMEs.

- Eligible companies will receive £27 from HMRC for every £100 of R&D investment.

The Government clearly recognises that its decision to cut tax relief for all SMEs in the Autumn Statement 2022 undermines its ambition to make Britain the next Silicon Valley. This redefined support for R&D-intensive businesses will allow the UK’s most innovative companies to do what they do best. However, it is a lot more targeted and, therefore, not as accessible. Companies must spend 40% of their expenditure on R&D activities to be eligible for this new rate. The Government estimates that about 8,000 companies could benefit, about 10% of current claimants. All other small businesses will still feel the pinch of the cut to the SME scheme, and there will be a knock-on effect on the UK’s innovation as a result.

Furthermore, while its definition of “research-intensive SMEs” is clear, it would be great to see green innovation incorporated into this. It was disappointing not to hear more mention of funding for R&D in environmental technologies, in which the UK could be a world leader. Specific tax incentives must be considered around green R&D to drive forward the sustainable transition. If they can include that in definitions, it could boost both our innovation and net-zero objectives.

Replacement of super-deduction with 100% First Year Allowance

- Super-deduction was due to end on 31st March 2023

- From 1st April 2023 to 31st March 2026, a 100% First Year Allowance comes into effect.

Companies across the UK can write off the total cost of qualifying main-rate plant and machinery investments in the year of investment. There is also a 50% first-year allowance for companies investing in special rate and long-life assets.

This is a very impressive and significant measure. What previously would have taken ten years will now take just one, helping to inspire inward investment in the UK. It is an encouraging signal for our Clients and will naturally have a positive effect on the innovation landscape in the UK.

Ayming welcomes the super-deduction replacement for capital expensing as this should drive investment into the UK and, combined with the existing R&D incentives, will lead to even more significant R&D activity in the country.

Merging the UK’s R&D tax relief schemes

- The Government is still considering responses to the consultation

- A final decision will come at a future fiscal event.

The Government’s consultation on merging the R&D Expenditure Credit (RDEC) and SME schemes closed on 13th March. No decision has been made yet, and the Budget documentation states a final decision will be made at a future fiscal event.

The Government will publish draft legislation on a merged scheme for technical consultation alongside the publication of the draft Finance Bill in the summer, with a summary of responses to the consultation. It is Ayming’s view that a merger will happen.

Restrictions on overseas expenditure in R&D tax relief

- Restrictions delayed to 1st April 2024

The previously announced restriction on some overseas expenditures will now be effective from 1st April 2024 instead of 1st April 2023. This delay will allow the Government to consider the interaction between this restriction and the potential merged R&D schemes. Ayming is delighted with this announcement, buried deep in the Budget documentation, as it will allow companies another year to include such expenditure in their claims.

Tackling abuse and improving compliance

- Supporting materials confirm ‘additional information requirements’ from 1st August 2023

Aiming to prevent abuse and increase transparency, from 1st August 2023, companies making R&D relief claims must do so digitally and provide a compulsory additional information form that breaks down costs and describes the R&D activity. Claim notification and endorsement by a named senior officer of the company are required. Details of any agents involved must also be included.

Companies will need to inform HMRC, in advance, that they plan to make a claim. They will need to do this, using a digital service, within six months of the end of the period of account to which the claim relates. Claim notification will only be required when a customer has not made an R&D claim for three years ending with the day before the first day of the claim notification period.

The additional information form will be required for all claims made on or after 1st August 2023. Exceptions include those companies exempt from the requirement to deliver a Company Tax Return online.

No mention of Horizon Europe

It is somewhat disappointing that there was no mention of Horizon Europe in the Budget. This is a critical topic for many of our clients and the broader innovation industry, and the UK scientific community deserves clarity on the subject. If the Government means what it says and truly wants to make the UK a global science superpower, then access to schemes such as Horizon Europe is crucial.

AI, Quantum & the Manchester Prize

- Introduction of The Quantum Strategy – £2.5 billion over the next ten years.

- Introduction of The Manchester Prize – £1 million each year for the next ten years to researchers that drive progress in critical areas of AI.

The Government aims to ensure the UK is home to world-leading quantum computing science and engineering, supports businesses through innovation funding opportunities, and provides access to world-leading R&D facilities. The Chancellor also reiterated the Government’s commitment to the British AI industry, the necessary legislation it would undoubtedly require as the technology becomes more commonplace, and introduced the Manchester Prize to award leading researchers into the topic.

This is excellent news for the UK’s advanced AI industry, and it is promising that the Government recognises the importance of recent movements in the area.

Accelerating Innovation

Twenty-six innovative R&D initiatives will receive £100 million in funding from the Government through the Innovation Accelerators program. This will boost the development of 3 high-potential innovation clusters, including the Manchester Turing Innovation Hub, two quantum projects in Glasgow led by the University of Glasgow and M-Squared Lasers Limited, and a project to speed up new health and medical technologies led by the University of Birmingham.

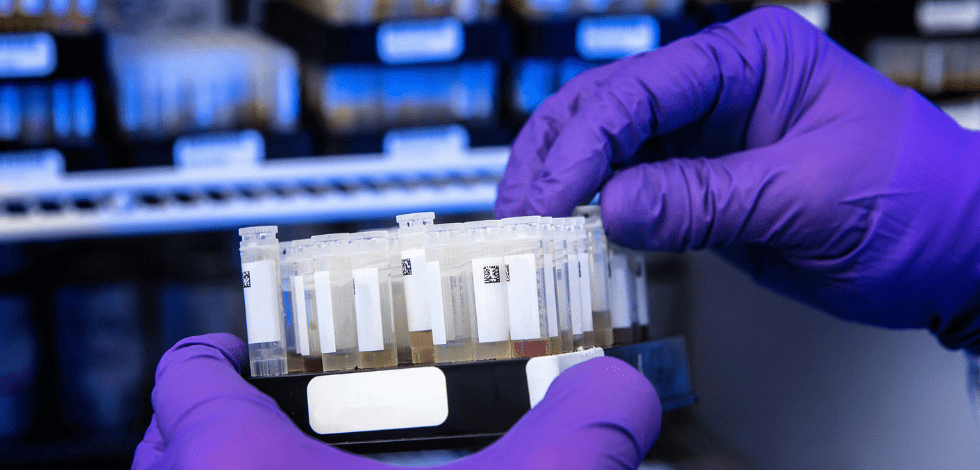

Positive news for Life Sciences

With significant R&D hubs like Cambridge’s Biomedical Campus, the UK is a global leader in the Life Sciences sector. The rail line connecting Oxford and Cambridge, East West Rail, will support continued expansion in the region’s life sciences and other high-productivity sectors by bridging companies and talent. The Government will confirm the new Bedford-Cambridge section’s route in May, and capacity funding will be available to assist local governments in creating their strategies for strategic economic growth around new stations.

Based on Sir Patrick Vallance’s interim findings in the ‘Pro-innovation Regulation of Technologies Review‘, the Government is providing extra funding for the Medicines and Healthcare products Regulatory Agency (MHRA) to help accelerate patient access to treatments.

It’s also promising that the Government is launching a refocused Investment Zones programme to catalyse 12 high-potential knowledge-intensive growth clusters across the UK.

If you have questions or comments on the Spring Budget 2023, either a query about the specificities or worries that it will affect your existing claim, please get in touch, and we will be happy to discuss in more detail.

Image Credit: Sean Aidan Calderbank/Shutterstock.com